Restaurant labor cost is a calculation that helps managers make staffing decisions. There are two ways to look at your restaurant labor costs—as a rolling calculation that shows if your daily staffing levels are in line with your sales, or as a post-mortem, month-end number that includes all your employee-related costs from salaries to benefits.

Most restaurants aim for a daily labor cost percentage of 12% to 15% and a month-end overall labor cost percentage of no more than 30%. Here’s how to calculate restaurant labor costs and my best advice for lowering your labor costs.

Free Labor Cost Calculator

This calculator template includes three versions of a restaurant labor cost calculator: detailed and simple versions of a daily labor cost calculator for hourly staff, and an overall labor cost calculator for figuring month-end and year-end labor costs.

If you use multiple systems to track payroll information—with employee pay rates and hours worked stored separately—you’ll want the detailed daily calculator. If you can easily pull your staff wage costs from your point-of-sale (POS) system or time clock, the simple daily calculator will do. The overall labor cost calculator provides a more complex picture of your restaurant’s overall health.

What Is Restaurant Labor Cost?

Restaurant labor cost is a calculation that shows how much money you spend on wages compared to your topline sales. Labor cost in restaurants is expressed as a percentage of sales. So, you might hear someone say, “Lunch labor cost was 12%,” meaning that they spent 12% of their overall sales on labor costs for the timeframe they analyzed.

But like many restaurant terms, “labor cost” can mean two different things depending on when the calculation was made and what you are trying to measure. You can measure restaurant labor cost for a day, a day part (like lunch or dinner), a week, a month, a year—whatever timeframe you want to analyze.

Daily Labor Cost Calculation

Most restaurant managers calculate labor cost for hourly staff by the day. Daily restaurant labor cost percentage is a simple, rolling calculation that helps you make real-time staffing decisions. So it doesn’t typically include fixed costs like salaries, payroll taxes, benefits, and salaries.

Typically, you figure daily labor cost to tell you if you have the right number of hourly staff working or if you need to adjust your staffing levels. The simple calculation does this best. Most restaurants want to see a daily labor cost of 15% or less.

Overall Labor Cost Calculation

When you are calculating larger metrics at the end of the month or quarter, you will also hear the term labor cost in conversations about prime costs. These month-end, quarterly, or year-end labor cost calculations are measuring the overall health of the restaurant operation, not trying to make real-time staffing decisions, so the calculation is more complex.

An overall restaurant labor cost calculation consists of hourly wages, salaries, bonuses, employee benefits—virtually any cost that is attributable to your salaried and hourly employees—compared to your sales. With all of these costs combined, most restaurants aim for an overall labor cost percentage of 30% or less by month-end or year-end.

How do these numbers work together? If your daily labor costs for your hourly staff stay between 12% and 15%, you’ll be on course for an overall labor cost of 30% by the end of the month or year.

How to Calculate Restaurant Labor Cost

To figure your restaurant’s labor cost, you need two numbers—your total labor cost for a set period of time and your total sales for the same timeframe. So, to figure your daily labor cost, you’ll need to know how much money you spent on hourly labor for that day, and you’ll also need your total sales for the same day. With those two numbers in hand, the calculation is simple:

Restaurant Labor Cost Formula

(Total Labor Cost $ ÷ Total Sales $) X 100 = Restaurant Labor Cost %

The restaurant labor cost formula is the same whether you are performing a simple daily labor cost calculation or an overall labor cost calculation at month- or year-end. The difference in complexity depends on how many figures you include in the “total labor cost” category.

For example, let’s say you are figuring a simple daily labor cost to decide whether to send home (aka, “cut”) some hourly staff. Your sales for the day so far are $2,500, and your labor costs are $594.50, split between the front of house and back of house. Your labor cost calculation would look something like this.

($594.50 ÷ $2,500) X 100 = 23.78%

That’s over the daily labor cost target of 12% to 15%. So you know you could cut some staff– or hustle to increase sales– to lower your labor cost for the rest of the day.

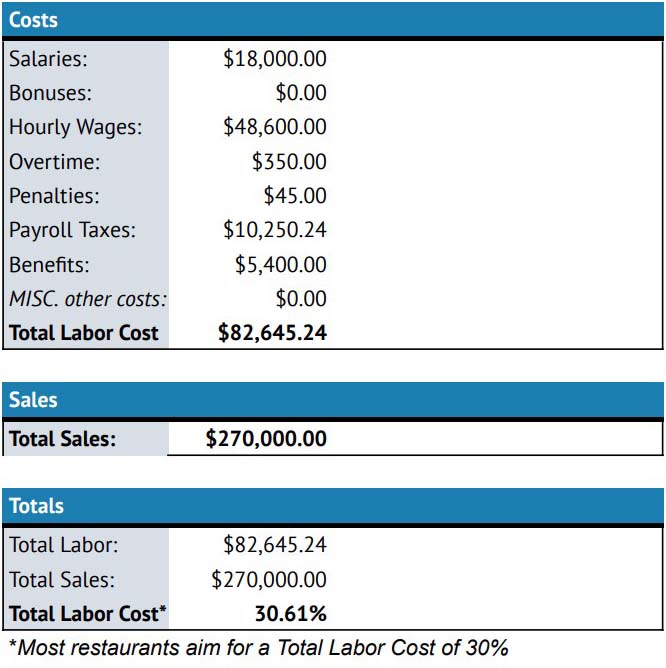

The calculation gets a little longer if you’re figuring your overall labor cost for a whole month. You’ll have more costs to compile to arrive at your overall labor dollars spent. Your total labor dollars spent for the month will include salaries, benefits, and payroll taxes in addition to hourly wages. Your calculation could look something like this:

[($18,000 + $48,600 + $350 + $45 + $10,250.24 + $5400) ÷ $270,000] X 100 = 30.61%

If your eyes are crossing, that’s OK. Let’s plug those numbers into the overall labor cost page of our labor cost calculator spreadsheet. This is what that looks like:

Better, right? Our fictional restaurant is close to target, just over 30%, for overall labor cost. If they could increase sales by $200 per day, or reduce their overtime and penalties, they’d be right on point.

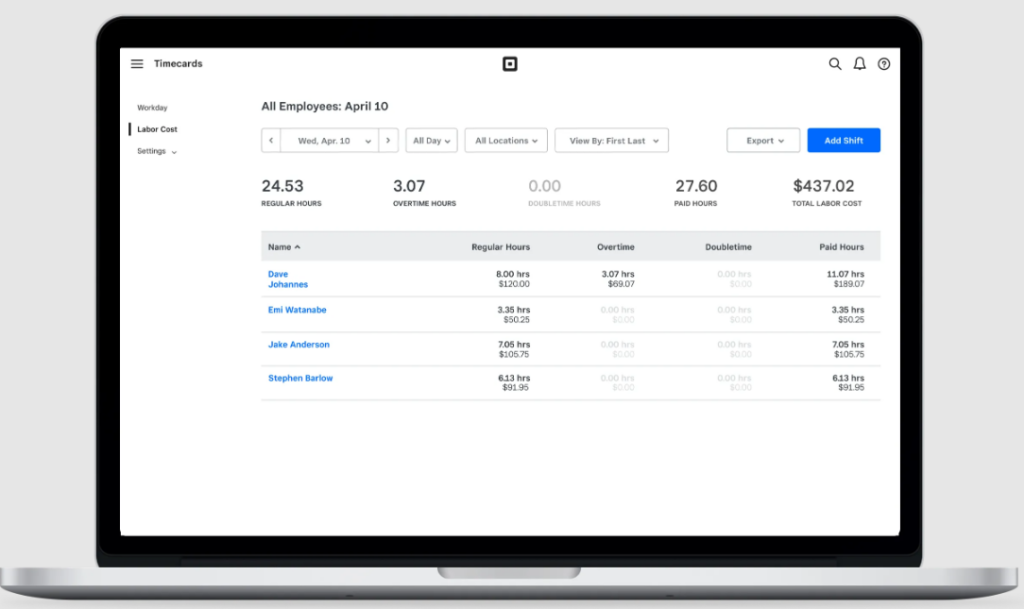

Depending on the number of systems you use and the type of labor cost you are calculating, it could take some serious time to gather all the information you need. You might need to get labor cost numbers from your timekeeping system, total sales from your register, and information about benefits costs from a profit and loss report, for example. If your timekeeping software doesn’t log each employee’s hourly wages, you might also need to compute your staff member’s wages for the actual number of hours they worked.

Ideal Restaurant Labor Cost

Restaurants want to keep their overall labor costs around 30%. In fine dining restaurants that require a large kitchen staff, the labor costs might be a bit higher—closer to 33% to 38%. But 30% is the industry standard for most restaurants to turn a profit.

If you calculate a daily labor cost to keep your hourly labor costs on track, you generally want to see a daily labor cost from 12% to 15%. This ensures that you’ll stay below the 30% threshold for overall labor costs once you add the costs of payroll taxes, benefits, etc.

How to Lower Restaurant Labor Cost

Controlling labor costs is a major component of daily restaurant management. These are some tips for lowering your labor costs and keeping your operation on track for profitability.

Create a Labor Budget (and Stick to It)

Use a labor budget when you create your hourly staff schedule. Decide how much money you can afford to spend on hourly wages each day, and translate that to the number of hours you can afford to schedule. You can break your labor budget down further by role, so you know exactly how many hours you can schedule your servers, bartenders, and cooks.

Your budget should vary based on your historic sales and customer traffic, so give yourself a bigger budget for busy Saturday nights and Sunday brunches. Then build your schedule with your labor budget in mind. If you don’t schedule more hours than you budgeted for, you’re more likely to keep your costs in line.

Many restaurant scheduling software apps will alert you when your schedule plan is going over budget. See our guide to the best restaurant scheduling software to save yourself time and headaches.

Enforce Clock-ins

Set your time clock to reject clock-ins if your staff clocks in too early. It might sound nitpicky, but if everyone clocks in 10 minutes early, that can add up to a lot of money by the end of the month. I always like to program in a grace period of a few minutes on either side of a staff member’s scheduled clock-in time so it’s not too much of a hassle.

Enforcing clock-ins requires that you use a POS with built-in scheduling software, or that your timeclock integrates with your scheduling software. Check that your systems are in sync.

Avoid Penalties

California has a meal break violation penalty equivalent to one hour’s wages if you fail to provide a meal break after five hours. New York City charges a penalty for scheduling hourly workers to work a closing shift one day followed by an opening shift the next day (aka, “clopening.”) Overtime pay can also be considered a type of penalty, requiring employers to pay a higher hourly wage for keeping workers over 40 hours per week or—in some places—more than eight hours per day.

These penalties add up, and they are all avoidable with a little planning. Schedule employee breaks to avoid meal break penalties in California. Avoid scheduling “clopens” in New York (and double-check the clopening potential before approving employee shift swaps). Note any employees who are close to hitting overtime at the beginning of your shift so you can get them off the clock before overtime hits.

Increase Sales

High sales cover a multitude of issues, including high labor cost. If you feel that you can’t possibly cut more labor hours but your labor costs are still high, you need to increase sales. Increasing sales doesn’t always mean raising prices. It could be that your dining room staff needs training to upsell and cross-sell the menu more effectively. Or, it might be time for your chef to redesign the menu to offer more compelling choices. If you don’t already run a loyalty program, consider adding one to drive repeat business, or expanding into special events and catering to generate off-site revenue.

Analyze Labor Costs Daily

The best way to lower your labor costs is to keep them on your mind. When I manage a restaurant, I check my labor costs for each day part (breakfast, lunch, happy hour, dinner) so I can make staffing adjustments on the fly. I also always include labor cost tracking in daily manager logs so the whole management team can identify patterns and suggest solutions to correct any labor cost overages.

If you track labor costs daily, you’ll never be surprised by your month-end or year-end reports, and you’ll begin to identify labor overages before they happen and adjust your staffing levels accordingly.

Restaurant Labor Cost Challenges

Restaurants are a people business, never more so than when we’re talking about labor. Because when we talk about labor, we’re talking about the people who show up to your restaurant every day and make it run.

After more than a decade managing restaurants—and a few working as hourly as a server, host, and barista—the biggest challenge I see in managing restaurant labor costs is remembering the people on the other side of the labor cost equation. It is easy to get wrapped up in the numbers—especially if your manager bonus is tied to a target labor cost—and forget that cutting hours for your staff can have real impacts on their lives, and long-term consequences for your restaurant if they can no longer afford to work with you.

When you see the word “cost,” your immediate reaction may be to “cut” that cost. But as this guide demonstrates, restaurant labor costs are more complex, so you have more options than simple cutting. I always prefer to think about managing labor costs, rather than cutting labor costs. This simple shift in perspective reminds me that I have other options, like growing sales, looking for new revenue opportunities, or shifting my hours of operation to manage the labor costs.

The Future of Restaurant Labor Cost

Many states and cities have increased minimum wages for hourly and tipped workers over the past five years. Recently, California passed a bill that increases the minimum wage for fast food workers to $20 per hour. Even if your local minimum wage hasn’t increased, you might need to increase your wages to attract employees.

At the same time, more locations are adding penalties for tight scheduling of hourly workers, failure to honor meal breaks, or requiring overtime pay to start after eight to 12 hours daily, rather than 40 hours per week. So labor costs in the restaurant industry are sure to rise over the next couple of years.

While restaurant owners will likely need to spend more to pay individual restaurant employees, you may be able to keep costs in line by considering other places to innovate and automate. Consider setting up automated responses to frequently asked questions on your social media accounts, or turning over your phones to an automated attendant rather than staffing a host during slower hours between lunch and dinner services.

Smart use of new restaurant software for scheduling, employee onboarding, payroll, accounting, and inventory management can save you time doing administrative tasks and allow you to be on the kitchen or on the floor more often, driving new sales. Sales could be the key to lowering restaurant labor costs in the future. You can future-proof your restaurant now by building new revenue streams—like adding catering services or online ordering—to offset rising labor costs.

Last Bite

Restaurant labor cost percentage is a simple calculation that tells you how well you are controlling your operational costs. Daily labor cost calculations have less detail than an overall labor cost calculation that you might perform at month-end or year-end. Simple daily labor cost calculations help you make real-time staffing decisions while overall labor cost calculations tell you how well you are keeping your costs in line in the long term. Figuring daily labor cost helps keep you on track for keeping your overall restaurant labor cost percentage below 30%.