A restaurant financial audit is the process of assessing your restaurant’s financial state—including your costs, profit and loss (P&L), and anticipatory costs for any upcoming maintenance or larger purchases—most commonly and effectively done at the end of each month. Regularly auditing your restaurant ensures you meet your financial goals and helps you see what you need to adjust to hit those goals.

The way restaurants conduct their audits varies slightly from business to business, so it is important to remember that there is no completely wrong way to go about it. If you end up with a clear financial picture at the end of your audit, you’ve done it right.

Below are some of my suggestions and the crucial steps you should expect to take when performing a financial audit for a restaurant, especially if you are new to this area of restaurant management. I also discuss tools you can use and why audits are so essential to restaurants.

Step 1: Gather Financial Statements

The first thing to tick off your restaurant financial audit checklist is gathering the essential financial statements. Three of the reports that will include the data you need for an audit are the profit and loss statement, balance sheet, and statement of cash flow. If you use accounting software like QuickBooks, you can generally pull these statements from the reporting dashboard. If you have a bookkeeper or accountant, they can send you these statements. Let’s look at each one in more detail.

Profit & Loss Statement

A profit and loss (P&L) statement shows a restaurant’s revenue and expenses, which helps you determine your net income for a given time period. This is important as it shows how successful you and your team were in controlling your costs and gaining revenue from customers. Your P&L also shows you what you need to work on to hit your financial goals.

A P&L statement will go over your labor cost, food and beverage cost (otherwise known as COGS or cost of goods), and your sales. How this plays into the general audit of your restaurant is that you can then use this data to meet with your team and come up with ways to fix any areas that may be suffering. On top of that, you can see how much capital you have on hand for any big purchase or repairs, as this fluctuates month-to-month based on your financial performance. This is why getting your P&L right while also collecting the data above accurately is so important.

Balance Sheet

Your balance sheet is a document that lists your assets, liabilities, and equity for your business. If the P&L is the lever that shows how much revenue or loss you have made in a given time period, your balance sheet is the tool that shows how your financial health is as a business. The equation for a balance sheet is your Assets = Liabilities + Equity.

A balance sheet is important as it shows the money you have in assets, the debt you currently owe and owe in the future, and the retained earnings or money you will take home. Again, this is the picture to see your true financial stability at any given time period.

Statement of Cash Flow

The cash flow statement is good to have on hand, especially when reviewed on a quarterly basis. This is where the combination of the P&L and balance sheet will come into play. It shows how money is coming in and where it is going out. This is important for areas such as a big purchase of equipment. You can see over time if you have covered that purchase or if you are still in the red on this purchase. This document is especially useful in a larger quarterly audit.

Step 2: Gather Additional Reports & Information

The second step in any restaurant audit is to gather any relevant data or supporting data you may need for the statements above. How you gather this data will vary based on the tools you use to run your restaurant. If you use a point-of-sale (POS) system, you’ll start by pulling sales reports to find credit card information, voids, sales, and other relevant data. You might get inventory counts and food waste information from your inventory software and labor and payroll data from your timekeeping system.

But if you don’t use software for sales and inventory tracking, you’ll get your financial data from cash register receipts, vendor invoices, and manual inventory counts.

If you have these types of reports, they will help you in your restaurant audit process:

- Monthly inventory count: Your inventory count shows your current food and beverage costs, as well as the value of the products you have in-house. Your inventory count might be a spreadsheet or a report you pull from your inventory management software (if you use one).

- Vendor invoice tracker: My colleagues and I recommend digital invoice tracking for restaurants because having automated systems and digital copies is the best way to ensure this data makes it to the end-of-month audit. If you track invoices on a spreadsheet, you may also want to grab the physical copies of invoices to double-check prices, double charges, or missing credits for returned products.

- Vendor credits: If you use inventory or accounting software to pay vendors electronically, this information will show on a report. If you pay vendors directly from your business bank account, you’ll want to check your bank statement for the month in question.

- Daily sales reports: This comes from your POS or cash register reports.

- Item voids: This also comes from your POS or cash register reporting system.

- Tax remittance: Depending on your system for paying sales and payroll taxes, this will come from your accounting software, bank statement, or bookkeeper.

- Daily cash counts: Most restaurants include these in daily closing paperwork, but some POS systems will track your cash counts digitally. Digital counts are worth using if your POS supports them since they are searchable and can easily reveal patterns in cash mismanagement.

- Payroll report: This report will come from your payroll processor, and will show how much you spent on wages, salaries, benefits, and payroll taxes in the timeframe you are considering.

- Manager log: Many modern restaurant POS systems include a digital manager log, but you can also log information manually in a spreadsheet or notebook. Manager logs are incredibly helpful if you need to diagnose an issue in your monthly audit.

All of these items need to be tracked and calculated for your monthly audit. We will discuss exactly how you’ll use these in a later step. For now, you’re just gathering all the data.

Step 3: Verify Financial Statements Against Your Operational Reports

For true accuracy in audits, the next big step is to compare your financial statements for the timeframe you are considering with the reports and data you gathered in step one. You will want to double-check the invoices owed for each of your vendors. This can be done by calling them and checking that each invoice owed for that given time period has been entered and accounted for.

The same can be done for credits they may owe back to you. Reports such as safe closing reports and daily sales reports can verify more granular information that you may have, especially if there seems to be a discrepancy in reporting. Implementing the system of double-checking your work, either through POS technology, vendor portals, or your own system of tracking, is vital to ensure an audit is done with accuracy.

Step 4: Conduct Final Review

The last piece of the puzzle in your monthly audit is to conduct a final review. Most restaurants do this final review in a month-end management meeting. Bring your key decision-making managers from the kitchen and front of house together to review your financial reports.

Bringing the team together for the audit has two major benefits. Different managers may see issues that you missed, and they may have insights and information that help resolve puzzling numbers. For example, if your voids and discounts for a month look high, your events manager might remind everyone that you built in a generous discount for a large catering order for a friend of the restaurant. Or your front of house manager might recall that they ran a lot of checks for a trainee that were later voided.

I like to follow this format for restaurant audit meetings:

- Step 4.1: Review reports. Provide copies of all the reports you plan to discuss with all managers. Make sure you have pens and highlighters available during the meeting so people can make notations.

- Step 4.2: Solve puzzles. Have a conversation about any numbers that seem out of line, over budget, or otherwise puzzling. See if your other managers can help shed light on where or how a number got off track.

- Step 4.3: Collaborate on a future plan. Problem-solve with your managers on a plan to get metrics on target for the month ahead. If your food cost was over budget this month, can your chefs and managers negotiate lower prices with vendors? If your revenue was lower than expected, are you scheduling enough staff to drive sales? Or could you drive more revenue through online ordering, catering, events, or other channels?

- Step 4.4: Discuss emerging issues. After you create a plan to address your opportunities for improvement, bring up emergent issues. This might include staffing needs, imminent repairs, equipment that is coming due for maintenance, or furnishings and equipment that need to be replaced. As with your future plans, collaborate with your managers to formulate a plan to address these needs.

- Step 4.5: Thank your team. Audit meetings can stir up a lot of uncomfortable feelings, especially if the numbers show lots of room for improvement. Take time to thank your management team for their hard work in the past month and their insights in the audit meeting. Remind them (and yourself) that these audits are not about assigning blame or making people feel bad; they are critical check-ins to evaluate the health of the business and help you all collaborate on plans to keep the business strong.

This final review meeting gives you not only the state of the business from that month but also a stepping stone into the next month when it comes to hitting your financial goals. From here, you can work with your staff on any gaps or challenges in order to perform better as a business in the next month.

If you have a dedicated accountant or bookkeeper, invite them to your audits, either in-person or virtually. Having someone experienced in restaurant finances and general business financial health helps you understand the data you have and can draw your attention to numbers you might have missed.

I cannot stress enough how having a designated employee trained in financial services, such as an accountant or bookkeeper, can be a game changer for your restaurant’s financial health. A bookkeeper will typically alert you to numbers or metrics that look off in real time and can save hours of problem-solving during restaurant audits.

Restaurant Financial Audit Challenges

Restaurant audits can be challenging because they rely on information from multiple sources, and that information passes through a lot of hands. At every point—from a server ringing in an order, a bartender counting liquor inventory, or a line cook preparing a dish—there is room for human error. Whether it is tracking down invoicing, incorrect or lack of voids in a POS system, poor food cost tracking, or inaccurate inventory counts, the audit process can be a challenge for any business owner.

Below are some of the challenges to be aware of when in the audit process.

Poor Inventory Counts

One of the most important aspects of finding accurate costs, which then generates the P&L and then, ultimately, affects the audit, is inventory counting. The lack of a proper inventory tracking system or inaccurate inventory tracking can lead to a false financial picture that can devastate your business in the long run. This process also helps you catch issues like missing products, excessive ordering, and overall food waste.

I empathize with managers responsible for inventory. Depending on your restaurant, it can be a very lengthy process that you have limited time to perform. Therefore, it is always best to create count sheets that are easy to fill information into, schedules for inventory counting to be performed, and adequate time and space for the counts to be reviewed and submitted accurately. They are as essential as the preparation of food for a dish or the making of a cocktail for a guest—and need consistent and thoughtful effort.

For inventory, be sure a higher-level manager is doing these counts. They hold the information for your audit that you need and should be done by those with positions of authority within a restaurant. If you are new to inventory counts, a weekly or bi-weekly count is recommended to keep on track and manage food waste trends.

Poor Invoice Tracking

As we mentioned above, poor invoice tracking can lead to a lot of issues. Staying current with your vendors is vital to your reputation as a business and the way you track your finances, so ensuring you have a system to track all invoicing is key. Using digital systems is preferred, as you can make monthly folders, which then can be organized by vendor for ease of access. Training your managers and those receiving deliveries of goods on your invoice tracking system is the best way to ensure you know exactly what you owe and what you are paying.

Inconsistent Price Checks

Another big part of the audit process is price checks. I recommend at least a monthly review of ingredient prices from your vendors. In this process, you can also compare with other vendors and bargain for better overall pricing. Checking that you are getting competitive and fair pricing is key when trying to make a profit and hit financial goals. Every cent makes a difference, so doing consistent price checks is essential. Without it, you may be paying increased pricing without even knowing it. These negotiations are best handled by the manager with the closest relationship with the vendor—for example, the chef in the kitchen and bar manager or lead bartender for liquor vendors.

Lack of Food Waste/Beverage Waste Tracking

Tracking your food and beverage waste is key, especially with alcohol. Noting if a bottle of liquor has broken or if a large recipe was overcooked allows you to account for the negative hits these types of events will contribute to your costs. Once you start tracing waste, you can anticipate the kind of food and liquor costs you will have and work with your staff on reducing these waste issues. Without this kind of tracking, you may be wasting a ton of food, which will then lead to you having higher COGS percentages. Counts on protein items, prep lists compared to the amount of prep used, and any discarded leftover or miscooked food should all be tracked.

Unorganized Processes

Not having an organized process dedicated to all of the other challenges above leads to very difficult audits. You may arrive at numbers with little reason for how you got there, you may perform badly financially and not know why, and you might put your business at risk of failing without the clear picture an audit will give you. Being organized in your operation when it comes to tracking everything that comes back to finances is key. Having dedicated SOPs in place on all matters of your business, from labor tracking to invoice collection, will avoid the pain of a frustrating audit that is both not accurate and not representative of the work and business you are running.

Lack of a Follow-up Plan

The last important piece to stress when doing an audit is that you need to act on the information and data you receive from it. The best way to do this is to hold a meeting with all leaders in the FOH and BOH and go over exactly what needs to be done. Maybe you ran too much overtime this last month? Finding ways to be more efficient in the kitchen and dining room is needed. Food cost is over by 2%? Re-training on prep, writing accurate prep lists, and ensuring all food is accounted for is the mission of the chef and leaders under them. Liquor cost is too high? Ensuring bartenders are trained on pours and that all dispensing systems are in working order is your next move.

Following up on an audit is integral to making your business better. The best restaurant operators see their monthly audit as the chance they have to get closer to being a profitable business that serves great food and a great environment for their employees to work in. The audit gives you the blueprint of issues you have in your business, and it is up to the operators of that business to act. Use the data from the audit not to condemn staff but to train, realign, and fix any challenges your restaurant and staff may be facing.

Restaurant Financial Audit Best Practices

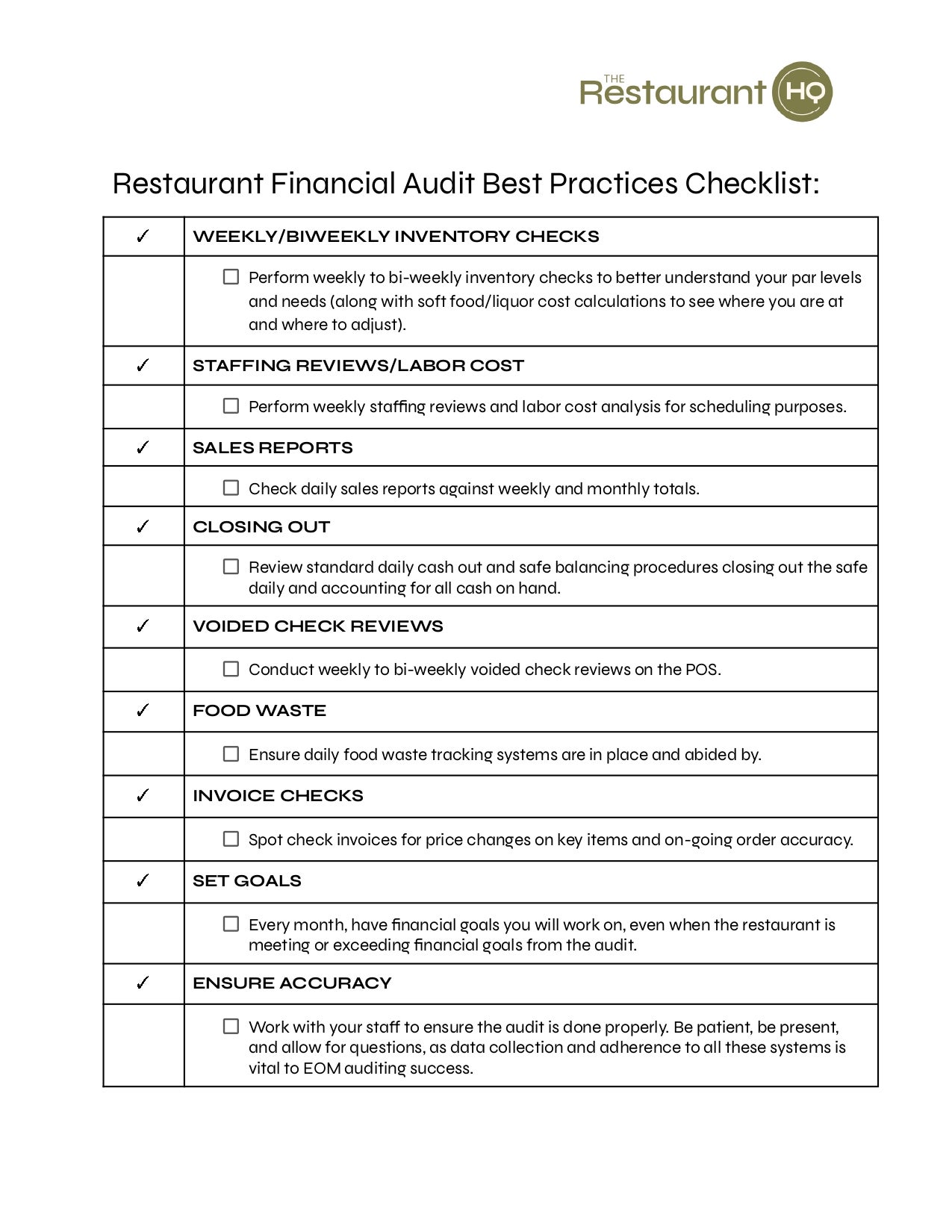

The best way to conduct a restaurant audit is to be consistently organized in collecting your restaurant’s financial data. Below is a list of some of the many tasks we suggest to ensure your audit goes as smoothly as possible.

Download our free restaurant financial audit best practices checklist for more details:

Tools for Performing a Restaurant Financial Audit

There are many tools on the market to help you better perform your restaurant audit. Any software you use, from point of sale (POS) systems, reservation systems, inventory software, or accounting tools are valuable sources for financial audits. You might also rely on people, like bookkeepers and your managers.

Here’s a deeper look at the kind of tools that might help with your next restaurant financial audit:

- Inventory software: Major companies like Chipotle, Sweetgreen, Chili’s and more use inventory software to audit their inventory and food costs. These tools help manage audits and typically offer a suite of other tools for day-to-day restaurant management, including invoice tracking and even payments. MarketMan and Crunchtime are popular options.

- Point of sale (POS) software: Most restaurant POS systems have all the reporting functions you need for an audit. From daily, monthly, and annual sales data, to product mix reports that show your popular menu items and labor reports, a good POS is a valuable resource in auditing your restaurant processes.

- Bookkeeper: Many independent restaurants rely on a bookkeeper to keep track of monthly, quarterly, and and annual financial data. If you use a bookkeeper, loop them into your regular audit process. They can create custom reports to show you the information you need to make the best decisions.

- Accounting software: For smaller restaurants, accounting software (like QuickBooks, Xero, and others) helps track financial data, run monthly reports, and keep relevant tax information ready each year. You might run this software yourself, or rely on your bookkeeper to do it.

- Spreadsheets: Many restaurants use shared spreadsheets for tracking, calendars, or daily manager logs. You can use free tools like Google Sheets or pay for Microsoft Office.

Frequently Asked Questions (FAQs)

Click through the sections below for some of the most common questions I encounter about conducting restaurant audits.

Bottom Line

As you can see, restaurant financial audits are an important part of owning a restaurant. There are not many processes like the end-of-month audit that give you detailed insight into your business in such a clear manner. With excellent organization, easy-to-follow systems, and staff buy-in you will be able to conduct audits that allow you to grow and maintain success as a restaurant. Give them the proper time, focus, and effort and the rewards will be great. They are vital to your success as an operator in the short term and to the overall existence of your business in the long term.