Tip out is the term restaurant workers use to describe the act of distributing tips from one tipped employee to another. Tipping out is a necessary part of restaurant operations because only some tipped workers can process payments and, thereby, collect the physical tips. In a tip-out arrangement, servers and bartenders collect the tips and distribute them to other tipped workers like bussers, barbacks, and—depending on local labor laws—kitchen staff.

Managing tip outs is a regular part of restaurant management. By the letter of the law, tips belong to the employee they were given to. But employers can establish a tip-sharing policy as a condition of employment. Requiring tipped staff to share tips is not illegal, but there are tipping laws employers must follow. There are several ways to arrange your tip-sharing policy. What works best will depend on your staff configuration and service style.

Tip-out Types

There are two major types of tip out: tip out as a percentage of tips and tip out as a percentage of sales. They are both pretty straightforward. Either one starts with the individual workers who process payments—usually servers and bartenders—distributing a portion of the tips they collect to other tipped workers. Keep reading for a full description of each tip-out type, along with its benefits and drawbacks.

Tip out by Percentage of Tips

Tipping out based on a percentage of tips is the most straightforward way to distribute tips among a service team. Each supporting service position is assigned a percentage of total tips collected based on their level of responsibility. Usually the total amount “tipped out” is between 20% to 45% of a server’s total collected tips.

This is what tip out by percentage of tips looks like the example below.

Tip-collecting staff collect tips. They tip out the following percentages of their total collected tips to these other tipped co-workers:

- Bartender: 10%

- Busser: 7%

- Runner: 5%

- Host: 3%

With real-world money, it would break down like this. A server collects $100 in tips. She tips out:

- $10 to the bartender who made her drinks

- $7 to the busser who cleared and reset her tables

- $5 to the runner who ran out the food

- $3 to the host who greeted and seated the guests

- She keeps $75.

It makes sense to use tip out by percentage of tips when:

- Your staff configuration is similar from shift to shift.

- You want to drive individual sales.

- You aim to mitigate the effects of low-tipping tables.

The percentages per position vary from restaurant to restaurant, depending on the level of responsibility in each role and style of service. If there is no food runner and the bussers run food, then bussers might be tipped 10%. If a restaurant only offers wine and beer service, a bartender might be tipped out a lower percentage—or there might be no bartender to tip out.

One major drawback to tipping out by percentage of tips, though, is it’s easy to hide cash tips and only tip out on credit card tips. So, you may sometimes have to mediate arguments between tip-collecting staff and support staff who think they are getting shorted. And with the 2025 “no tax on tips” tax deduction, reporting cash tips accurately becomes all the more important.

Tip Out by Percentage of Sales

Almost as popular as tipping out based on percentage of tips is tipping out based on percentage of sales. This format has the benefit of providing a clearer paper trail for staff and management. Servers and bartenders can’t fake their sales—it is printed in gray and white on their end-of-shift report. So, you’ll likely see fewer disagreements or misunderstandings about the tip-out amounts.

The general format for a tip out by percentage of sales looks like this. A restaurant requires the tip-collecting waitstaff member to tip out each supporting team member in the following format:

- Bartender: 10% of beverage sales

- Busser: 3% of overall sales

- Runner: 3% of food sales

- Host: 1% of overall sales

A real-life example would break down like this. A server sells $500, broken out by these categories:

- $100 in drinks

- $400 in food

She earns $100 in tips on those sales. She tips out:

- $10 to the bartender who made her drinks ($100 x 0.10)

- $15 to the busser who cleared & reset her tables ($500 x 0.03)

- $13 to the runner who ran out the food ($400 x 0.03)

- $5 to the host who greeted and seated the guests ($500 x 0.01)

Her total tip out is $43.00. She keeps $57.

Choosing to tip out based on percentage of sales makes sense in a few specific scenarios:

- Your support staff does a lot of supporting work and are seasoned professionals.

- You want to reward individual effort.

- You have few tables that fail to tip.

- You want to reward high-tip-earning servers.

A major drawback of the percentage of sales tip-out model is that it can force servers to bear the brunt of low-tipping tables. If the server in our example above had a table that left little or no tip—say, she only collected $75 in total tips—she would still have to tip out $43. In this case, she would only have $32 for herself.

Tip-out Costs

There is more to consider about tip-outs than the size of everyone’s portion. Any business that handles or distributes gratuities will incur related costs. Beyond the standard payroll taxes, credit card processing fees are associated with credit card tips. The more detailed your tip structure, the more managerial time you will need to spend overseeing it.

These are a few tip-out costs that a restaurant owner should be prepared for:

- Credit card processing fees: Some 70%–80% of your customers will tip with a credit card. Like the rest of your credit card payments, your business will incur a 3%–4% processing fee from your merchant services provider. Some states permit restaurant owners to retain this amount from employee tips. Your local Department of Labor website will provide accurate information about city or state guidelines.

- Payroll taxes: If tipped employees earn more than $20 per month in tips, employers are obligated to withhold Social Security, Medicare, and income taxes from the reported tips, as well as pay the employer’s portion of Federal Unemployment Tax (FUTA) and Federal Insurance Contribution (FICA) on reported tips. If you turn over service charges or auto-gratuities to your employee tip pool, you’ll also need to pay payroll taxes on those monies just as you would with regular, hourly wages.

- Employee complaints: Restaurants from TGI Fridays to high-end restaurants like Per Se have been sued by employees alleging wage theft due to misallocation of tips. A complaint doesn’t need to reach the level of a lawsuit to cost a restaurant owner money. An employee complaint to the Wage and Hour Division of the Department of Labor can spur an investigation into your payroll records. Any errors they find can result in fines.

Managers and owners must also ensure that tips are accurately recorded for their payroll processor so the correct amount of withholding can be applied. Restaurants that pay out all tips in cash at the end of the shift should also consider the administrative time necessary to arrange change orders and make trips to the bank to replenish the cash supply.

Tip-out Pros & Cons

There are almost as many ways to compensate service staff as there are types of restaurants. In fact, some restaurants choose not to permit tipping at all. What works for one business may not be the best solution for another, so it is important to consider all the pros and cons before choosing a direction for your business.

| pros | cons |

|---|---|

| Spread the wealth: Sharing tips across the staff makes compensation more equitable across a restaurant, increasing teamwork and staff morale. | Over-competition can impede service: Unregulated tip-outs can lead to “deals” among the service staff, negatively impacting the guest experience. |

| Create performance incentives: When all service staff earn a portion of tips, they are incentivized to help increase sales and provide a high level of customer service. | Staff can feel unequal: Even with the most thoughtfully designed tip-out system, some staff members can feel disgruntled that other roles earn a higher percentage of tips. |

| Familiar to employees: Most seasoned restaurant teams are familiar with receiving tips, pooling tips, and tipping out colleagues. It is a relatively transparent system that lets the staff directly see compensation for their efforts. | Record keeping takes time: Designing and enforcing a tip pool takes time daily. The more complicated the tip-out or pooling arrangement, the more time it can take. |

Tip-out Alternative: Tip Pooling

An alternative to traditional tip out is tip pooling. Tip pools are a slightly more complicated form of tipping out. In the case of a pool, all the tips customers give in a single service are combined into one pot. The pooled tips are then distributed to service staff based on a predetermined formula. The same laws apply tip pools as tip outs, though some states prohibit tip pooling. So check your local labor laws before deciding on a tip-sharing strategy.

Tip Out vs Tip Pool: What Is the Difference?

There are two basic types of tip shares in restaurants: tip out and tip pooling. The only difference between a tip out and tip pool is how the tips are gathered and distributed.

- In a traditional tip out, staff that collect tips from customers give a portion of their tips to the other staff members who helped them, like the busser who cleared and reset their tables. This may be a voluntary choice from the server or—more frequently—a mandated amount set by the restaurant.

- In a tip pool, all the tips collected by the staff in a single shift are pooled together. Pooled tips are then distributed to all tipped workers based on a set formula of points or percentages based on their role.

As with tip outs, there are several ways to format tip pools.

Pools based on the hours worked are popular in quick-service restaurants, while pools based on “points” make more sense in full-service. Some restaurants with a large staff prefer a pool based on points and hours. Expand the sections below to take a deeper look at different tip pool models.

Pooled house: Restaurants with a tip pool are frequently called “pooled houses.” You’ll hear this frequently when interviewing front-of-house workers (i.e., “Is this a pooled house?”). Some staff prefer pooled houses, while others prefer a tip-out structure.

Service Charges & Auto-gratuities

Technically, service charges and automatic gratuities (auto-grats), are not classified as gratuities by law. Since they are not an amount the customer spontaneously and voluntarily adds, they do not have the same legal restrictions as tips. Technically, service charges and auto-grats are the restaurant’s property, counted as revenue. And the restaurant can do whatever they want with them.

So, you can—as nearly all restaurants do—turn over auto-grats and service charges to the tip pool. Or you can give only a portion of these monies to the tip pool and give a portion of the service charge to the kitchen or catering salesperson who booked the large party. But in addition to the flexibility, service charges and auto-grats are seen as revenue by the Internal Revenue Service (IRS). So, if you put auto-grats in the tip pool, you’ll need to pay payroll taxes on those amounts in addition to the Social Security and Medicare taxes you pay on distributed tips.

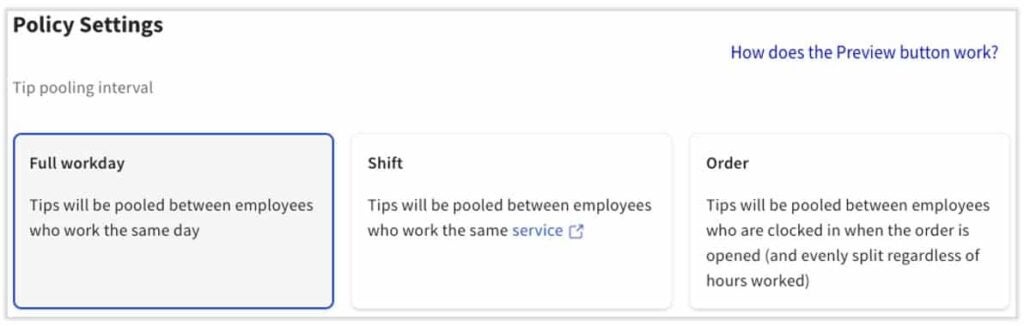

POS Tip Management

If all this tip out and tip pooling sounds like too much math on a daily basis, you should know that some of the best restaurant POS systems can manage your tip outs or tip pools for you. And if your POS system doesn’t cut it, there are several top tipping software solutions on the market.

POS brands and app developers have been refining this software for a while, and it has come a long way in recent years. So, if you looked at tip management software and disregarded it before 2020, it’s worth another look. With a POS-assist, you typically just do the complicated work of adding your tip-out percentages or pool points into your POS one time. Then the system will print tip distributions for you at the end of each shift.

For reporting and staff reference, you can simply print a tip report, reducing the administrative work that can sometimes take a couple of hours a week.

Frequently Asked Questions (FAQs)

Tips, tip outs, and tip pooling are consistently complex topics in the restaurant industry. These are the most common questions I encounter.

Last Bite

Tip outs—and tip pools—have been a part of the restaurant business model for generations. There may be no single solution that works for every restaurant. The best place to begin deciding which tip-out model is right for your business is with the federal and local labor laws that govern tips and service charges in your area. Whichever model you choose, be sure that you are reporting all tips received by and distributed to your employees so that the appropriate taxes can be withheld.