Catering businesses are easy to start from your home or a commercial kitchen, so it’s easy to skip steps in setting up your business. When you are focused on creating menus and signing up clients, it can be easy to overlook the need for catering insurance. Catering insurance covers your catering business for several outcomes, from foodborne illness to damage to your or a client’s property. This guide has everything you need to know about catering insurance costs and coverage.

Why Catering Insurance Is Important

Every year, catering businesses experience accidents, employee injuries, and outbreaks of foodborne illness. In fact, a Centers for Disease Control (CDC) report found that the majority of foodborne illness outbreaks from 2009 to 2015 occurred in retail food establishments (including restaurants and caterers). And every wedding season, you read new stories about whole wedding receptions falling victim to foodborne illnesses (that are usually tied to the caterer).

Catering insurance can also protect your business in the case of these common catering occurrences:

- Burns and fires: Catering equipment is full of steaming hot water, and containers of heating fuel. Accidents can happen at any time, causing burns and sometimes even fires.

- Cuts: Serving food in locations that are not designed for food service leads to temporary setups, which can lead to accidents like cuts during food prep.

- Falls: With staff working in unfamiliar locations, that are typically not designed for food service, trips and falls are common.

- Tipped appliances: When you’re building remote kitchens on client sites, appliances can tip over due to wind, weather, tent collapses, and more.

- Vehicle accidents: Caterers often drive vans and larger vehicles to transport food and equipment to offsite events, and vehicle accidents are common.

What Is Catering Insurance?

Catering insurance is a package of insurance policies tailored to cover the unique risks and needs of the catering industry. Catering insurance typically includes:

General Liability Insurance

All businesses need general liability insurance. Some counties also require proof of general liability coverage for small businesses that serve food to the public before they issue a business license. General liability protects your business in the case of bodily injury or property damage claims from clients or vendors. Your general liability coverage would kick in if a broken bottle of balsamic vinegar stains a client’s carpet or a tent you constructed flies into a parking lot and damages cars.

Commercial Property Insurance

Commercial property insurance covers your property—at specific locations—against specified, named losses. Your commercial property insurance will list exactly the events and losses that your business is covered for. Common coverages include losses due to fire, theft, or vandalism. If there is a common occurrence in your location, like tornadoes or other weather events, you’ll want to be sure that your commercial property insurance covers that, too.

Business Owner’s Policy (BOP)

Depending on your business size and structure, you may benefit from a business owner’s policy. Also called a BOP, this is a bundle that combines general liability with commercial property coverages. Business owners opting for a BOP tend to see slightly lower overall insurance costs. Ask your insurance provider if a BOP is an option for your catering business and make sure it contains all the coverages you need before committing.

Off-premise Insurance

Off-premise coverage is a clause that can be added to your commercial property insurance. For caterers that store equipment at a secondary location or operate equipment at offsite locations, off-premise insurance can be necessary to protect the equipment you store or use when away from your primary business location.

Food Vendor Liability Insurance

Anytime you serve food to the public, you should have food vendor liability insurance. This coverage protects your business against claims of foodborne illness or accidental cross-contamination. Some carriers offer vendor liability as an endorsement on your general liability policy, which can help you get all your coverage from a single carrier.

Food Spoilage

Food spoilage coverage is exactly what it sounds like. This policy protects your business from losses associated with food spoilage. This may be due to power outages and loss of refrigeration or because a client cancels at the last minute. Some carriers also add food spoilage endorsements to their general liability policy for food businesses; so ask if you need separate coverage, or if you can add it to your main policy.

Specialty Catering Coverages

Depending on your catering business setup, you may need additional coverages to further protect your business. These could include:

Worker’s Compensation Insurance

If you have employees, as most mid-sized to large caterers do, you’ll need workers’ compensation insurance. Every state except Texas and South Dakota requires workers comp insurance and most also set a minimum coverage requirement. This policy covers your business in the case of an employee’s injury or illness while working for your catering company.

Commercial Automobile Insurance

Commercial auto insurance covers your catering company against losses associated with accidents caused by your commercial catering vehicles. The minimum coverage requirements for commercial auto liability are set by the state and may vary from place to place.

If you took out a loan to purchase your catering vehicles, your lender will likely require you to insure the vehicle itself, too. Considering that a catering van is a major part of an offsite catering business, it is smart to purchase as much auto coverage as you can afford. A higher monthly premium is easily less costly than replacing your van if you cause an accident or are hit by an uninsured driver.

Hired Not Owned Automobile

A Hired Not Owned Auto (HNOA) policy is commonly used by delivery companies that rely on employees to transport products in their personal vehicles. HNOA coverage tends to be lower cost than a full commercial auto policy and protects your employees from losses or damage they cause while driving their personal vehicles in the course of working for your catering company.

Liquor Liability Insurance

In most cases, the venue you work with will have liquor coverage. But if you provide bar service or your employees serve alcohol of any kind, liquor liability can protect you from losses associated with serving alcohol. These might be claims or fees associated with over-serving, or losses or injuries that result from inebriated clients or employees.

Inland Marine Insurance

Inland marine may sound odd. But it is surprisingly not insurance for catering on a boat. Inland marine coverage protects your equipment while it is in transit from one location to another. If you transfer cooking equipment, generators, serving utensils, and other property to offsite events, you absolutely need inland marine coverage to protect you from loss or damage while in transit.

How Much Does Catering Insurance Cost?

Catering business insurance costs vary based on your business size, operating location, and the services you offer. On average, independent caterers can expect to pay in the following ranges annually for their major catering insurance policy premiums:

- General Liability: $288 to $850

- Commercial Property: $400 to $1,500

- Worker’s Compensation: $350 to $1,200

These price ranges may seem large. Catering business sizes range widely from home-based caterers operating from a licensed home kitchen to full-service catering companies with corporate kitchens and an army of staff operating nearly 24 hours a day. So, don’t be frightened by any large numbers on that list. Your catering insurance rates will be tailored to your business size.

How to Save on Catering Insurance

Many caterers—especially home-based catering businesses—operate under the table. So, it can be tempting to stay in the shadows and avoid purchasing catering insurance. I absolutely do not recommend either of these moves. If you accept money for providing catering services, you should register your business with the relevant local authorities and insure your business.

If the costs concern you, you can control your catering business insurance costs in a few ways:

- Start small: Limit your product and service offerings until you can afford more coverage. You might only offer catered food for pick up and avoid buying (and insuring) a vehicle or hiring staff (and purchasing a worker’s comp policy) until you have started turning a profit.

- Get safety training: Get a food safety certification even if your state doesn’t require it. Take a fire safety course and learn how to extinguish various types of fires. Provide proof of your training to your insurance provider. Even if your insurer doesn’t offer a discount for these certifications, they can save you money in the form of avoided accidents and claims.

- Use a single carrier: Caterers generally see some savings—up to 10%—when they purchase all of their insurance coverage from a single carrier. Your ability to do this will depend on whether your carrier offers specialty coverages like inland marine and commercial auto, but most major carriers will have all the coverage you need.

- Pay premiums annually: If you have the cash on hand, try to pay your premiums annually rather than monthly. Most carriers will offer a discount—from 2% to 5%—for annual, upfront premium payments.

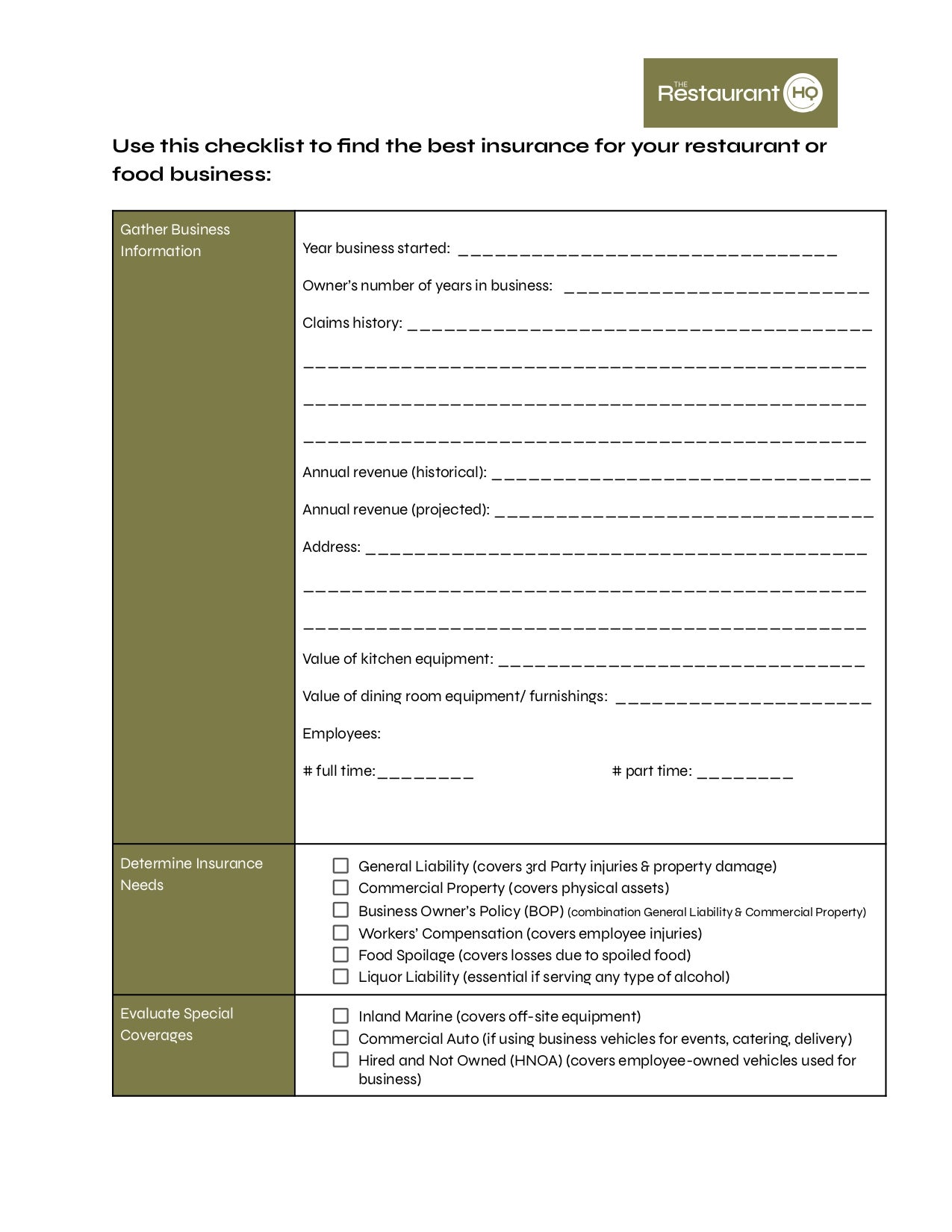

Here’s a step-by-step guide to finding catering insurance:

Step 1: Identify Your Risks

Consider each part of your catering operation, from where you receive, cook, and store your food to how you deliver it to your clients. Do you have employees, do you have vehicles? Do you have additional cooking, serving, or storage equipment you need to cover? Will you perform any of your services in a client’s home or other offsite venue? All of these variables will determine the coverage you ultimately need.

Step 2: Obtain Provider Quotes

Almost every major insurance provider offers small business coverage for general liability, commercial property, or a business owner’s policy, which is basically a combination of the two. For some of the more specialized coverages—liquor liability, food spoilage—you might need to find an insurer with direct experience in the food and beverage space. Talk to other caterers or restaurant owners and ask who they use. Then, request quotes from at least three providers.

Step 3: Compare Quotes

Compare the quotes you received to identify your best fit. As you compare, look beyond just the quoted premium. Are the coverages comparable? Is a provider offering more coverage in one area than another? Does the provider offer all the coverage types you need, or will you need to work with multiple providers to get your whole operation covered?

Step 4: Research Provider Reputation

Before committing to an insurance provider, research their reputation. Look for online reviews from customers and ask other caterers if they use (and like) the company you are considering.

FAQs

Catering insurance has a lot of angles to consider. These are some of the most common questions we hear about insurance for catering businesses.

Last Bite

Catering insurance is not one-size-fits-all. Whether you are a home-based caterer or a large corporate operation with multiple cooks and waitstaff, you can get customized catering insurance. Check with business owners in your network to identify providers that insure catering companies, then compare quotes from multiple providers to get the coverage you need.

ALSO READ