Buying a restaurant is a cost-effective way for first-time restaurant owners to enter the hospitality industry. Buying an existing restaurant is ideal for restaurateurs who want to step into a turnkey operation. Those who want to put their signature on a space, however, can buy a restaurant’s assets—such as the lease, furnishings, and kitchen equipment—and […]

Buying a restaurant is a cost-effective way for first-time restaurant owners to enter the hospitality industry. Buying an existing restaurant is ideal for restaurateurs who want to step into a turnkey operation. Those who want to put their signature on a space, however, can buy a restaurant’s assets—such as the lease, furnishings, and kitchen equipment—and rebrand the business.

Start your venture or fund your next big idea with low-risk financing options, from SBA loans to 401(k) rollovers. Work with Guidant Financial and get step-by-step guidance from industry experts, plus administrative and compliance support.

| pros | cons |

|---|---|

| Shortened opening timeline | Risks may be hidden |

| Fewer Permits to Secure | May need to rehab restaurant reputation |

| Operation is already organized | May need to rehab restaurant’s reputation |

When you are in the process of starting a restaurant, buying an existing business can save you time and money. An existing restaurant already has the necessary operating permits and licenses. Specialized equipment like kitchen hoods and grease traps are already properly installed. Building and health inspections have already been completed. If you plan to keep the whole concept from furniture to menus, you will also inherit vendor relationships and employees.

There are some risks, however. If the seller has failed to pay vendors or the restaurant has low ratings on popular consumer sites like Yelp, you may need to rebrand the business. Your cost savings will also depend on making as few changes as possible to the restaurant space. So if you have a dream restaurant floor plan, you may need to wait to see it built. What you buy when you purchase a restaurant will vary depending on the restaurant’s profitability and reputation.

The first step to buying a restaurant will be finding one that is available for sale. There are a couple of ways to find restaurants for sale. The most common are working with a broker or searching online listing websites. Before you visit your first listing, you’ll also want to take time to narrow down the type of restaurant you are looking for.

A restaurant business consists of three major assets: the business entity itself, the real estate, and equipment and inventory. When buying a restaurant, you can typically find listings for each asset individually or make a bulk purchase.

These assets can include:

If you intend to keep the restaurant running as is, you want to pursue a bulk purchase. A bulk purchase typically includes all of the assets listed above. If you plan to rebrand the business or dramatically renovate the space, purchasing only the relevant assets is a better option.

Ask yourself these questions to help determine what type of restaurant you are looking for:

Try to visit each restaurant you are considering anonymously as a customer first (also known as “secret shopping”). Experiencing the space from a customer perspective allows you to recognize the strengths and weaknesses of each restaurant. When dining, pay attention to general features like the ambiance and overall cleanliness of the space.

You should also note the flow of service. Are employees able to work around customers efficiently? Is there enough room at the bar, in the entryway, and the guest restrooms? Several other questions can help you determine if a restaurant space is the right fit for you:

If a restaurant business seems to fit your criteria, your next step is to contact the owner either directly or via a restaurant broker. Avoid identifying yourself as a potential buyer to restaurant employees; they may not know that the business is on the market.

When you revisit the restaurant as a potential buyer, pay special attention to the non-public areas of the space. If you are not an expert in kitchen equipment, try to bring along someone familiar with those systems who can assess the quality of the equipment.

There are typically two reasons restaurants become available for purchase: the business is not performing well or the owners are selling for personal reasons. You can tell why a restaurant is on the market by asking the seller. You can verify their reasoning by looking at the restaurant’s performance metrics.

Once you seriously inquire about purchasing the business, the current owners should be willing to provide you with some basic performance data. Some restaurant owners include a snapshot of this information in the listing itself, such as a statement like “$250,000 annual sales.” However, you should still ask to see the actual financial records to verify this. Most restaurant owners will ask you to sign a nondisclosure agreement (NDA) before looking at their financial records. Requesting an NDA is a standard practice to prevent competitors from acting in bad faith.

Some key performance indicators to ask about are:

Another major metric is cash flow. Cash flow is just the amount of cash flowing into the business, minus the cash that flows out of it. Positive cash flow simply means that a restaurant brings in more money than it spends. Cash flow is sort of a catch-all number, intended to provide a thumbnail sketch of the restaurant’s performance.

Cash flow is actually determined by the restaurant’s performance metrics described above. The metrics will show you exactly how cash is flowing in and out of the restaurant. For example, overall cash flow might look fine, but the underlying metrics indicate problems with labor or food cost. The question then becomes whether or not you have the ability (or appetite) to fix those problems. You might prefer to continue looking at other restaurants with fewer issues.

Whether a restaurant’s metrics are strong or weak will dictate your next move.

| Strong Metrics | weak metrics |

|---|---|

| If the restaurant has strong financial metrics, it is a great candidate for bulk purchase. These restaurants are great for buyers who want to keep the same menu, name, and brand. If you plan on making drastic changes, however, it might be a waste to buy a restaurant that is performing well as it is. | A restaurant that is not performing well financially may still be an exciting property for other reasons. Purchasing this type of restaurant makes sense for restaurant owners that plan only to buy assets and completely rebrand the business. Owners who feel equipped to correct cost issues may also be interested in this type of restaurant. For example, a high labor cost that is negatively impacting a restaurant’s bottom line isn’t a big deal if you know how to reduce labor costs. |

If you don’t have much restaurant experience or many restaurant industry connections in your area, working with a broker is your best bet. Two types of brokers can help: business brokers and commercial real estate brokers. Ideally, you want a business broker who specializes in restaurants. In smaller markets, however, you may have trouble finding someone this specialized. In that case, a commercial real estate broker will likely have the information you need.

Securing a business attorney is a must when buying a restaurant. You may just be learning how to buy a restaurant, but a good business attorney will have done this many times. Buying a business, particularly a restaurant, requires a lot of legal paperwork. If you are purchasing the entire business entity, you inherit relationships with state and federal tax authorities and assume liquor and health department permits. You will need to be doubly sure that your interests are protected.

A business attorney will draft or assess critical documents like:

You can find an attorney who specializes in business sales by contacting the local branch of the American Bar Association. Alternatively, several websites have searchable directories of attorneys in your area.

The appraisal is where you place an actual value on the business assets and the business itself. There are many different methods to determine a fair price for the sale of a restaurant business but most restaurants are evaluated by profit. A standard guideline for determining a ballpark restaurant value is to calculate three times the annual profit. For example, it would not be unusual to see a business that earns $150,000 in yearly profit listed for an asking price of $450,000.

That is just a general number, however. The actual value of a restaurant business depends on many other factors, such as the value of the restaurant’s equipment, location, and the overall climate of the restaurant market. There are also intangible qualities that may make a business more or less valuable. If the restaurant you are considering is a beloved local landmark, this may increase the restaurant’s value.

You’ll need to have your funding in line before negotiating the final purchase. Small business loans will likely be a part of your funding plan. However, to present a robust application to banks, it is essential to show that you are willing to invest personally in this business.

Plan to have at least 10% of the purchase price as a down payment. Qualifying for some small business loans, however, requires a down payment of up to 30%.

If you have a 401(k) from a previous job or a retirement account, you may be able to use some of these funds to invest in your business. You can invest personal money from savings, gather funds directly from investors, or crowdfund with small investments from family and friends.

To get favorable financing, you should have a personal credit score above 680, letters of recommendation, and a convincing business plan. Restaurant business loans can be tricky to obtain because lenders consider the restaurant industry as especially turbulent. Loans backed by the Small Business Administration (SBA) can make lenders more comfortable issuing credit to buy a restaurant.

Traditional banks issue SBA Loans but the SBA backs those loans, which reduces the risk to lenders. You can apply for an SBA loan via a local bank. Alternatively, you can use a lending marketplace which allows small businesses to complete a single application and reach hundreds of different lenders.

If your credit history is not strong enough to qualify for a small business loan, you will need to rely on personal resources or individual investors. Working with investors will require your attorney to draw up an investor agreement to govern the relationship between the investors and your business. This agreement should lay out the timeline on which investors will be repaid, and the additional benefits (such as dining discounts) they may receive.

With funding in place and a detailed evaluation of the business’s assets, it is time to consider which assets you want and how much you are willing to pay for them. This process will likely require a few rounds of negotiation with the seller. This is where your attorney (and restaurant broker if you use one) will really show their value.

You want to understand precisely what you are getting for your money. Sometimes restaurant sellers plan to sell the equipment or liquor license separately and may seek other buyers for those items. If you are interested in specific licenses or equipment, make sure they are listed in your purchase agreement.

Don’t assume that an item is included in the sale—ask. Purchasing the menu does not necessarily mean that the current inventory of ingredients will be transferred. There are big ticket items like ovens and leases, but don’t forget small items like social media profiles. You’ll want to get the passwords to those turned over as part of the deal.

After you and the seller are on the same page about what assets you plan to purchase, you need your attorney to draft a letter of intent. A letter of intent is a non-binding agreement that outlines the broad terms and conditions of the final sale. It will include the expected purchase price based on the appraised value of the business. This letter essentially says that, barring anything strange appearing in your attorney’s analysis of the company, you intend to buy the business and at this price.

Performing due diligence is a similar process to the performance metrics analysis that you did previously. Due diligence, however, is more involved. Due diligence goes beyond cost-control and cash-flow considerations. It looks at the legal, structural, and operational side of the business in detail.

The point of the due diligence process is to gain a clear picture of the health of the entire business, not just the cash-flow. This step is essential before finalizing the sale. You can discover things during this step—like unpaid sales tax or workers’ compensation claims—that may affect your desire to purchase the business.

Ideally, nothing surprising pops up during your due diligence analysis. If something does, though, it is customary to adjust your proposed purchase price or add stipulations to the purchase agreement. For example, if due diligence reveals that the restaurant is late on a sales tax payment, your attorney will likely stipulate that those taxes are paid before you move forward.

Once you and the seller agree on the terms of the purchase, it is time to make it official. First, you and the seller should decide on a closing date—the date the business will transfer to you. Then, reach out to your lawyer to draft a purchase agreement. Once you and the seller have both signed the agreement, the sale will be complete on the closing date.

Before you choose a closing date, meet with the seller to discuss the details of transitioning the business. Typically, a restaurant closing date is scheduled at least two months after all parties agree to the sale. The time between reaching an agreement and closing on the deal is the time when you and the seller should transition all the restaurant systems. The transition can involve administrative tasks like updating permits and vendor accounts with your contact information and formally meeting employees.

In some cases, the seller may offer to train you for a couple of weeks. He or she may want to show you the ins and outs of the payroll systems, purchasing arrangements, and how to use the POS system. This training can be particularly helpful if you are buying a long-standing restaurant that has a loyal customer base. You will want the seller to introduce you to your regular customers personally.

During the transition period, you should also allow time for:

The purchase agreement is a binding contract that governs the terms of the sale. Your lawyer will need to create this document for you. Typically, the agreement contains the purchase price and closing date and lists the warranties and transactions that must take place before closing. It will also include a list of outstanding costs—like closing costs, renovation expenses, cost of transferring permits—and who is responsible for paying them.

Once your attorney has drafted the contract, you send it to the seller. The seller will likely have his or her attorney review it before signing. It is common practice for the buyer’s attorney to include a non-compete clause in the purchase agreement. A non-compete clause prevents the seller from opening a similar restaurant in the same market that could directly compete with the restaurant you just bought.

When the closing date arrives, you release the money to the seller and the seller releases ownership of the restaurant to you. Congratulations! Now it’s time to schedule a locksmith to change your locks and start managing your restaurant.

If you buy an established restaurant with good cash flow, you can expect to see 5% to 10% profit most months. Whether that is enough profit to offset your upfront costs of purchasing the restaurant will depend entirely on how much you paid for the restaurant. Most restaurant sale prices are based on 50% to 70% of the restaurant’s annual profits. So if you purchase wisely and manage the restaurant efficiently, you can start to break even at six to 12 months after your purchase.

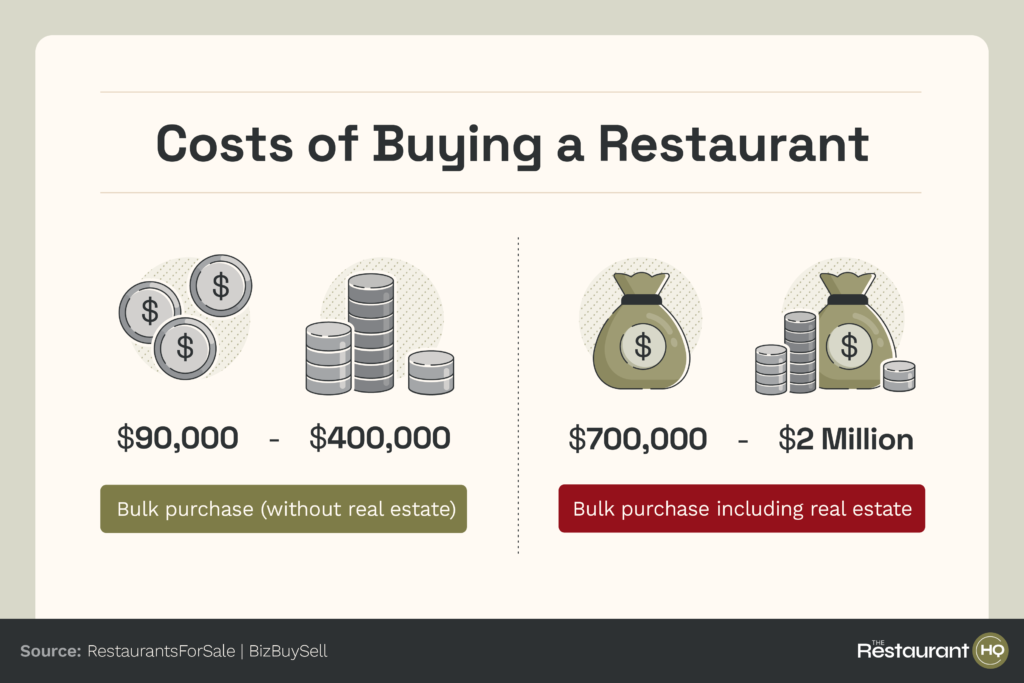

The cost of buying a restaurant varies based on location, restaurant type, restaurant cash flow, and whether the purchase includes the real estate the restaurant operates from. Full service restaurants with bars and liquor licenses cost more than counter service restaurants or diners that don’t sell liquor. Restaurants that struggle with cash flow, or are in a less populated location will be less expensive than profitable restaurants in a city center. And including real estate in the deal can more than double the cost.

Generally, you can expect to spend $90,000 to $400,000 on a restaurant business that operates from a rented location. If the sale includes real estate, the cost goes up to $700,000 to more than $2 million.

When buying a restaurant business, you want to do your due diligence. Check that the restaurant business is up to date on its taxes and payments to vendors. Verify that all necessary permits and licenses are current. Confirm what the sale price includes; equipment, furnishings, and even some licenses (like liquor licenses) may be sold separately.

If you are purchasing a restaurant that operates in a rented space, read the current lease agreement closely. You want to be sure that there is at least five years remaining on the current lease and that the terms are favorable. Look out for leases that require you to pay a percentage of monthly sales to the landlord; this essentially opens your books to the landlord, who will use the information to raise the rent when your lease is up for renewal.

Buying a fully operational, existing restaurant is a great way to get started in the restaurant business. Do your research and due diligence to ensure that you know each prospective restaurant’s strengths and weaknesses before you decide. A good business attorney is necessary to assess documents like leases and insurance policies, and to write a purchase agreement that works for you.

Mary King is a veteran restaurant manager with firsthand experience in all types of operations from coffee shops to Michelin-starred restaurants. Mary spent her entire hospitality career in independent restaurants, in markets from Chicago to Los Angeles. She has spent countless hours balancing tills, writing training manuals, analyzing reports and reconciling inventories. Mary has been featured in the NY Post amongst other publications, and in podcasts such as Culinary Now where she discussed starting your first restaurant, how to leverage your community and avoiding technology traps.

Property of TechnologyAdvice. © 2026 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this site are from companies from which TechnologyAdvice receives compensation. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. TechnologyAdvice does not include all companies or all types of products available in the marketplace.