Buying a restaurant is a cost-effective way for first-time restaurant owners to enter the hospitality industry. Buying an existing restaurant is ideal for restaurateurs who want to step into a turnkey operation. Those who want to put their signature on a space, however, can buy a restaurant’s assets—such as the lease, furnishings, and kitchen equipment—and rebrand the business.

Fund your first (or next!) restaurant with Guidant Financial

Start your venture or fund your next big idea with low-risk financing options, from SBA loans to 401(k) rollovers. Work with Guidant Financial and get step-by-step guidance from industry experts, plus administrative and compliance support.

Pros & Cons of Buying a Restaurant

| pros | cons |

|---|---|

| Shortened opening timeline | Risks may be hidden |

| Fewer Permits to Secure | May need to rehab restaurant reputation |

| Operation is already organized | May need to rehab restaurant’s reputation |

When you are in the process of starting a restaurant, buying an existing business can save you time and money. An existing restaurant already has the necessary operating permits and licenses. Specialized equipment like kitchen hoods and grease traps are already properly installed. Building and health inspections have already been completed. If you plan to keep the whole concept from furniture to menus, you will also inherit vendor relationships and employees.

There are some risks, however. If the seller has failed to pay vendors or the restaurant has low ratings on popular consumer sites like Yelp, you may need to rebrand the business. Your cost savings will also depend on making as few changes as possible to the restaurant space. So if you have a dream restaurant floor plan, you may need to wait to see it built. What you buy when you purchase a restaurant will vary depending on the restaurant’s profitability and reputation.

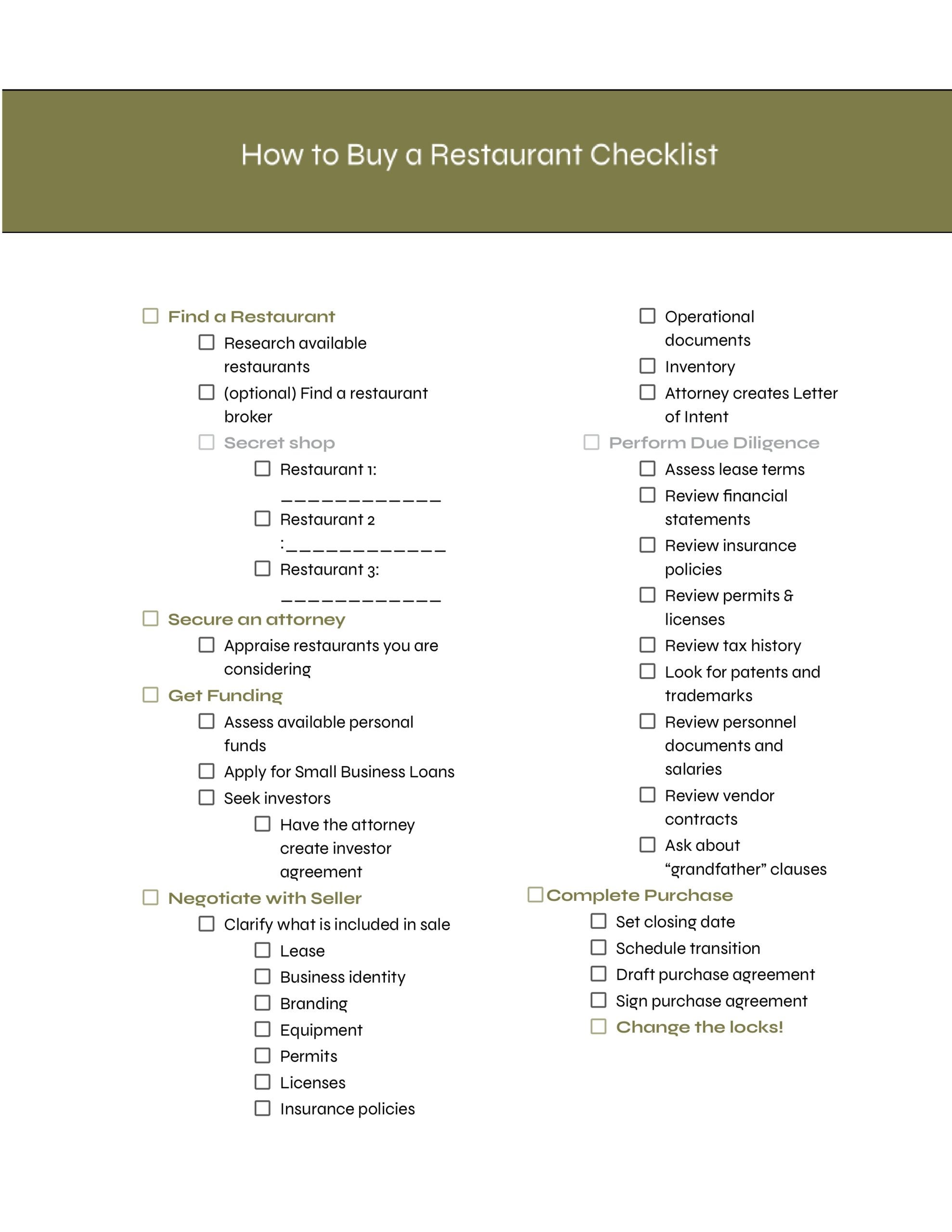

1. Find a Restaurant

The first step to buying a restaurant will be finding one that is available for sale. There are a couple of ways to find restaurants for sale. The most common are working with a broker or searching online listing websites. Before you visit your first listing, you’ll also want to take time to narrow down the type of restaurant you are looking for.

Where to Find Restaurants for Sale

If you don’t have much restaurant experience or many restaurant industry connections in your area, working with a broker is your best bet. Two types of brokers can help: business brokers and commercial real estate brokers. Ideally, you want a business broker who specializes in restaurants. In smaller markets, however, you may have trouble finding someone this specialized. In that case, a commercial real estate broker will likely have the information you need.

2. Secure a Lawyer & Evaluate the Business

Securing a business attorney is a must when buying a restaurant. You may just be learning how to buy a restaurant, but a good business attorney will have done this many times. Buying a business, particularly a restaurant, requires a lot of legal paperwork. If you are purchasing the entire business entity, you inherit relationships with state and federal tax authorities and assume liquor and health department permits. You will need to be doubly sure that your interests are protected.

A business attorney will draft or assess critical documents like:

- Letter of intent: This document memorializes your intent to purchase the restaurant and will set the basic terms and conditions of the purchase.

- Lease agreements: Buying an existing restaurant usually means taking over a current long-term commercial lease. An attorney will assess the lease terms and raise any red flags you might otherwise miss.

- Purchase agreement: Also referred to as a purchase contract or sales contract, the purchase agreement is the official document that governs the sale of the business. It lays out terms like the agreed-upon purchase price and any conditions that must be met by either party to complete the sale.

You can find an attorney who specializes in business sales by contacting the local branch of the American Bar Association. Alternatively, several websites have searchable directories of attorneys in your area.

Appraise the Business Value

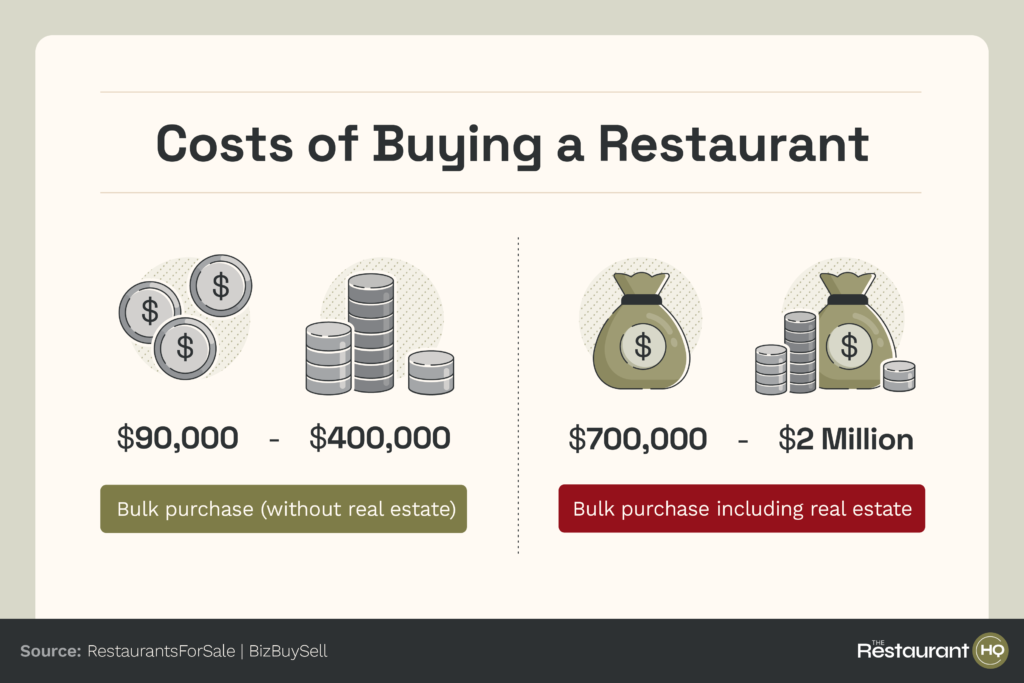

The appraisal is where you place an actual value on the business assets and the business itself. There are many different methods to determine a fair price for the sale of a restaurant business but most restaurants are evaluated by profit. A standard guideline for determining a ballpark restaurant value is to calculate three times the annual profit. For example, it would not be unusual to see a business that earns $150,000 in yearly profit listed for an asking price of $450,000.

That is just a general number, however. The actual value of a restaurant business depends on many other factors, such as the value of the restaurant’s equipment, location, and the overall climate of the restaurant market. There are also intangible qualities that may make a business more or less valuable. If the restaurant you are considering is a beloved local landmark, this may increase the restaurant’s value.

3. Get Funding

You’ll need to have your funding in line before negotiating the final purchase. Small business loans will likely be a part of your funding plan. However, to present a robust application to banks, it is essential to show that you are willing to invest personally in this business.

Personal Investment

Plan to have at least 10% of the purchase price as a down payment. Qualifying for some small business loans, however, requires a down payment of up to 30%.

If you have a 401(k) from a previous job or a retirement account, you may be able to use some of these funds to invest in your business. You can invest personal money from savings, gather funds directly from investors, or crowdfund with small investments from family and friends.

Loans

To get favorable financing, you should have a personal credit score above 680, letters of recommendation, and a convincing business plan. Restaurant business loans can be tricky to obtain because lenders consider the restaurant industry as especially turbulent. Loans backed by the Small Business Administration (SBA) can make lenders more comfortable issuing credit to buy a restaurant.

Traditional banks issue SBA Loans but the SBA backs those loans, which reduces the risk to lenders. You can apply for an SBA loan via a local bank. Alternatively, you can use a lending marketplace which allows small businesses to complete a single application and reach hundreds of different lenders.

Investors

If your credit history is not strong enough to qualify for a small business loan, you will need to rely on personal resources or individual investors. Working with investors will require your attorney to draw up an investor agreement to govern the relationship between the investors and your business. This agreement should lay out the timeline on which investors will be repaid, and the additional benefits (such as dining discounts) they may receive.

4. Negotiate With the Seller

With funding in place and a detailed evaluation of the business’s assets, it is time to consider which assets you want and how much you are willing to pay for them. This process will likely require a few rounds of negotiation with the seller. This is where your attorney (and restaurant broker if you use one) will really show their value.

Understand What You Are Buying

You want to understand precisely what you are getting for your money. Sometimes restaurant sellers plan to sell the equipment or liquor license separately and may seek other buyers for those items. If you are interested in specific licenses or equipment, make sure they are listed in your purchase agreement.

Don’t assume that an item is included in the sale—ask. Purchasing the menu does not necessarily mean that the current inventory of ingredients will be transferred. There are big ticket items like ovens and leases, but don’t forget small items like social media profiles. You’ll want to get the passwords to those turned over as part of the deal.

Sign a Letter of Intent

After you and the seller are on the same page about what assets you plan to purchase, you need your attorney to draft a letter of intent. A letter of intent is a non-binding agreement that outlines the broad terms and conditions of the final sale. It will include the expected purchase price based on the appraised value of the business. This letter essentially says that, barring anything strange appearing in your attorney’s analysis of the company, you intend to buy the business and at this price.

Do Your Due Diligence

Performing due diligence is a similar process to the performance metrics analysis that you did previously. Due diligence, however, is more involved. Due diligence goes beyond cost-control and cash-flow considerations. It looks at the legal, structural, and operational side of the business in detail.

The point of the due diligence process is to gain a clear picture of the health of the entire business, not just the cash-flow. This step is essential before finalizing the sale. You can discover things during this step—like unpaid sales tax or workers’ compensation claims—that may affect your desire to purchase the business.

Buying a Restaurant Due Diligence Checklist:

- The restaurant’s lease: Are there at least five years left on the lease contract? Are the other lease terms favorable? Do you have the option to sublease or transfer the lease in the future?

- Financial information: Consider balance sheets, income statements, and tax returns to confirm the restaurant’s financial performance records.

- Insurance policies: You will want to look at the restaurant’s general liability policy, workers’ compensation policy, and employee health insurance policies. Are the premium rates fair or are they due to increase soon? You’ll want to know about recent workers’ comp claims, especially if there are any outstanding.

- Permits and licenses: Determine what permits and licenses are tied to the business and confirm they have been renewed when necessary.

- Tax history: If you are buying the entire business, you will inherit the tax history. You’ll want to confirm that all current taxes have been paid.

- Patents and trademarks: If a restaurant has a trademarked name or a patented system for cooking the world’s best chicken wings, be sure these assets remain with the business you are purchasing.

- Personnel information: Look at employee salary information, payroll documentation, typical schedules, and employee bonus plans to confirm labor cost and prime cost performance metrics.

- Inventory and vendor contracts: You should also ask about existing contracts with vendors, especially if the menu depends on obscure or difficult to source ingredients.

- “Grandfathered” clauses: Long-existing businesses may have been excused from meeting building and health codes that updated while the business remained in the original owners’ hands. When a business changes hands, sometimes these “grandfathered -in” clauses will be voided, and you’ll need to bring the location up to current codes.

Ideally, nothing surprising pops up during your due diligence analysis. If something does, though, it is customary to adjust your proposed purchase price or add stipulations to the purchase agreement. For example, if due diligence reveals that the restaurant is late on a sales tax payment, your attorney will likely stipulate that those taxes are paid before you move forward.

5. Complete the Purchase

Once you and the seller agree on the terms of the purchase, it is time to make it official. First, you and the seller should decide on a closing date—the date the business will transfer to you. Then, reach out to your lawyer to draft a purchase agreement. Once you and the seller have both signed the agreement, the sale will be complete on the closing date.

Transition & Closing Date

Before you choose a closing date, meet with the seller to discuss the details of transitioning the business. Typically, a restaurant closing date is scheduled at least two months after all parties agree to the sale. The time between reaching an agreement and closing on the deal is the time when you and the seller should transition all the restaurant systems. The transition can involve administrative tasks like updating permits and vendor accounts with your contact information and formally meeting employees.

In some cases, the seller may offer to train you for a couple of weeks. He or she may want to show you the ins and outs of the payroll systems, purchasing arrangements, and how to use the POS system. This training can be particularly helpful if you are buying a long-standing restaurant that has a loyal customer base. You will want the seller to introduce you to your regular customers personally.

During the transition period, you should also allow time for:

- Code updates: If you had to make updates to the location, you’ll likely need new inspections from health and fire departments. Check with the appropriate authorities to ensure you have met all the necessary requirements.

- Renovations: The transition time also allows you or the seller to make any renovations that are required.

- Marketing: You may want to let the public know that the restaurant is under new management. If the business has a social media presence, ensure that transferring those accounts is part of the transition.

Draft a Purchase Agreement

The purchase agreement is a binding contract that governs the terms of the sale. Your lawyer will need to create this document for you. Typically, the agreement contains the purchase price and closing date and lists the warranties and transactions that must take place before closing. It will also include a list of outstanding costs—like closing costs, renovation expenses, cost of transferring permits—and who is responsible for paying them.

Sign the Purchase Agreement

Once your attorney has drafted the contract, you send it to the seller. The seller will likely have his or her attorney review it before signing. It is common practice for the buyer’s attorney to include a non-compete clause in the purchase agreement. A non-compete clause prevents the seller from opening a similar restaurant in the same market that could directly compete with the restaurant you just bought.

When the closing date arrives, you release the money to the seller and the seller releases ownership of the restaurant to you. Congratulations! Now it’s time to schedule a locksmith to change your locks and start managing your restaurant.

How to Buy a Restaurant Frequently Asked Questions (FAQs)

Bottom Line

Buying a fully operational, existing restaurant is a great way to get started in the restaurant business. Do your research and due diligence to ensure that you know each prospective restaurant’s strengths and weaknesses before you decide. A good business attorney is necessary to assess documents like leases and insurance policies, and to write a purchase agreement that works for you.

ALSO READ