There are many reasons you might want to close your restaurant business, some positive (like retirement or selling your business) and others less so (like a failed lease re-negotiation). Whatever your reasons, when closing a restaurant for good, it’s important to tie up all financial and legal loose ends so you can make a clean personal and professional break when you step away from your business.

Key Takeaways

- Decide in advance what conditions might lead you to close your restaurant.

- Understand that a closure can mean either a sale of the business or a liquidation of your assets.

- Ask for help from business attorneys, your vendors, your staff, and your customers when you need it.

- Remember to take care of yourself through the process.

If you’re considering permanent closure, here’s how to close a restaurant business in nine steps.

Step 1: Decide When to Quit

Sometimes it will be obvious when you need to close your restaurant business, such as when you fail to renegotiate a fair lease with your landlord. When there is no outside event forcing a closure, though, it can be difficult to know when you are truly done with your business. Many restaurant owners I know who have closed their businesses tell me that one of the biggest struggles in closing their restaurant was deciding it was finally time.

It may sound like a downer, but take a moment to think about what the deciding factor may be for you. If you know what you’re looking for, you’re less likely to miss the signs when they come. The breaking point will be different for everyone. You may decide to close after a certain number of profitless months or when you have put a certain amount of money into the business without seeing a return.

On a positive note, you may decide to close your restaurant when you have a certain amount in your retirement accounts or when you hit a certain point of profitability and the business becomes attractive to potential buyers. If your food and labor costs are low and profit margins are high, you’re more likely to get top dollar in a sale.

Related: Key Restaurant Metrics + How to Track Them

Step 2: Make a Choice—Sell or Liquidate?

Your next step is to decide whether you want to sell your restaurant business or liquidate your assets. If you are stepping away from a profitable restaurant or you own the building, selling your restaurant is probably the stronger choice. You’re more likely to break even or make some money on the deal. You may have to wait several months or even a year for the right buyer to come along, though. So if selling is your preference, give yourself enough time to attract a strong offer.

If you are closing your restaurant because of business struggles or lease challenges or if you don’t have the time to wait for the right buyer, liquidating is faster. Liquidating involves selling your assets separately (which we’ll discuss in more detail below) and closing the business entity completely.

Step 3: Set a Final Service Date

Decide when your final day of business will be. If you are closing due to a sale or an unrenewed lease, the closing date will be obvious. If your reasons for closing are not tied to a specific date, try to close after your busy season and before a slow season. It makes sense, for example, for a restaurant in a beach town to close in the fall rather than the spring.

Once you know the date of your final service, you can work backward from the closure date to organize all the tasks you need to complete. Allow yourself at least three months to close if you can. More time—up to a year—might be necessary if you plan to sell to an employee or offer training to a new owner. Some tasks (like paying your final tax bills) may happen long after your final service date. But you’ll need time to get your tax documents prepared and to close all your accounts, from your insurance policies to your phone service.

Give yourself enough lead time, and ask for help if you need it. If you have business partners, managers, or a bookkeeper, they can be especially helpful with determining how much time you need to accomplish all the necessary tasks before a closure and take some tasks off your plate.

Step 4: Prepare Final Tax & Dissolution Documents

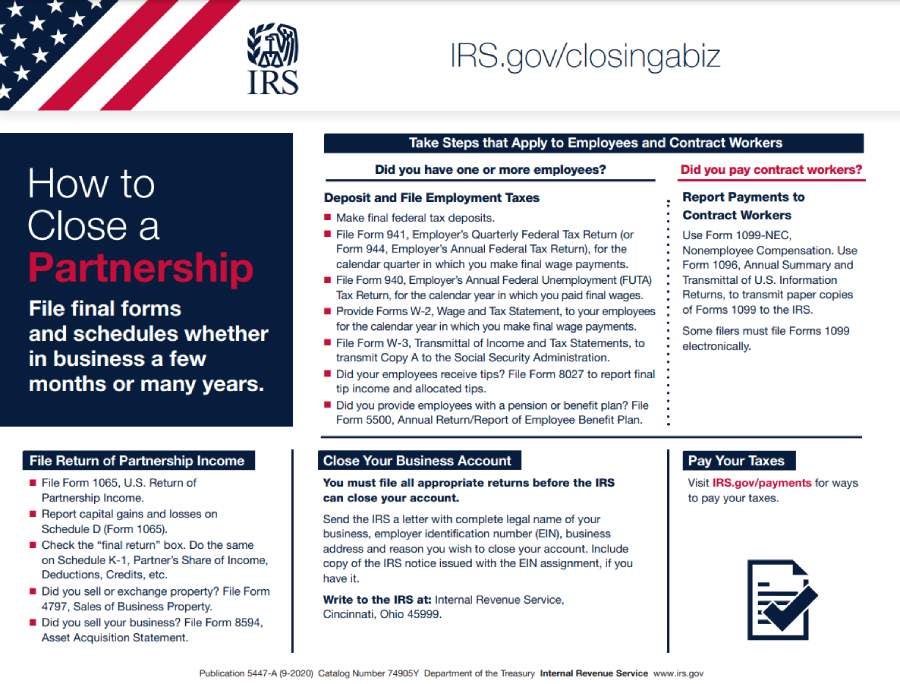

Just as you filed paperwork with the IRS and your secretary of state’s office when you started your business, you’ll need to contact them when you close your business. This may take some time, as you’ll need to file taxes for your final year in business and pay any outstanding sales, payroll, and other taxes affiliated with your business.

At the federal level, the IRS includes a handy list of documents you’ll need to file. These include:

- Final U.S. Corporate Income Tax Return for the final year of business

- Report of capital gains and losses (usually Schedule D or Form 1120, or Form 1120-S, depending on your business type)

- Final Schedule K-1 if your restaurant has shareholders/ investors

- Employer’s Quarterly Federal Tax Return or Employer’s Annual Tax Return

- Employer’s Annual Federal Unemployment Tax Return

- Employer’s Annual Information Return of Tip Income and Allocated Tips

- A letter containing your full business name, address, Employer Identification Number (EIN) and reason for closing your business (to cancel your EIN with the IRS)

Whether you sell the entire business or liquidate individual equipment assets by selling them, you’ll also need to file forms with the IRS to cover the funds you received from those sales. These may include:

- Form 4797 for Sales of a Business Property

- For 8594, Asset Acquisition Statement

You’ll need to file similar documents for your state income, payroll, and sales tax accounts. Each state’s procedure varies somewhat, so you should check with your state’s Secretary of State’s office or your local Small Business Development Center (SBDC) for guidance.

Preparing and filing these documents will take time, from a couple of months to a full year, depending on how long it takes to sell your business or assets. This is a lot of forms, and it can feel overwhelming. Gathering the necessary information and knowing which form to file where can make your head spin. Talk to your accountant, or find one if you don’t have one already, to help you prepare and file all of these forms correctly.

Step 5: Alert Vendors

Once you know your final service date, let your vendors know. Let them know, at the same time, that you will pay for your final orders in cash on delivery. It may feel scary, but letting your vendors know your plans is a big part of exiting your business in a positive way. Closing your restaurant in a positive way is important for maintaining a professional reputation, especially if you might open another food service business in the future.

Many of your suppliers are small businesses themselves, with local staff and families to support. Give them the opportunity to plan moves that will preserve and protect their businesses and employees when they lose your account.

Step 6: Notify Staff & Customers

We’ve all heard—and some of us have experienced—the horror stories of restaurants that notified staff and customers of a closure with a padlock and note on the front door. Sometimes an immediate closure happens, but you should do everything you can to avoid it. Take the time to let your staff and customers know when you will close your doors. Give customers and employees a chance to say goodbye and make other plans.

A friend of mine recently closed a popular restaurant when the landlord sold the building. He had known the closing date about a year in advance and shared the news with employees and customers immediately. Because his restaurant had been open for many years, customers with fond memories packed the dining room for the final year. This helped him have a profitable final year and gave him a chance to connect with dozens of regulars and former employees and hear what his restaurant meant to them.

You don’t need to give customers and employees a full year’s notice. But at least four to eight weeks gives your team and regular customers a chance to overcome their shock and make plans for their final shifts and celebrations in your restaurant.

It can be hard to know what to say when your restaurant is closing. Friends, staff, and customers will likely ask you why you are closing. It is fine to share the full details if you feel comfortable doing so. But if you’d rather not talk about it, practice saying “I’m ready for something new,” or “The timing makes sense for me and my family.”

Step 7: Liquidate Your Stock

If you are not selling your entire restaurant in a single transaction, you may choose to sell your equipment and supplies. Return any leased equipment to the lessor, and check your lease to ensure you don’t sell any items that should stay with the building (hot water tanks, HVAC equipment, etc.).

If your sellable stock is mostly servingware and furnishings, hosting a sale yourself is likely your best option. You can create social media posts and post on online forums like Craigslist or local listserv to alert buyers about your liquidation sale.

If you want to expand your reach and offload a lot of administrative work, consider working with a liquidation company. These companies specialize in selling business equipment and typically have a network of interested buyers they can contact. In many cases, a liquidator can find a single purchaser for most or all of your stock. You typically need to be selling some large or unique equipment to interest a liquidating company, though.

In some restaurant leases—especially ones where the landlord assisted with your restaurant renovation—cooking and refrigeration equipment may be jointly owned or owned outright by the landlord. Double-check your lease to be sure before you advertise equipment for sale.

Step 8: Pay Debts & Close Accounts

One of the final acts you need to complete before closing your restaurant for good is paying all of your business’s outstanding debts and closing any software and service accounts. Debts might be the cost of the final orders from your suppliers, federal and local income and payroll taxes, and software fees for any restaurant technology tools you use. Accounts you need to close include physical services (like linen supply and trash removal), utilities (like internet and electricity), software (like POS and reservation systems), and supplier accounts. The accounts you have will vary based on your restaurant type.

Depending on your contracts for equipment and services, you may need to pay the cost of your complete contract term. For example, if you have a three-year contract with your restaurant POS provider and you close your restaurant two years into that contract, you may be on the hook for a full year’s worth of monthly software fees.

Read your contracts carefully and contact each provider to negotiate a cancellation. In many cases, software providers will negotiate a cancellation fee that is lower than a full year’s fees. If you have a payment plan for hardware or equipment, though, those are typically harder to negotiate. In every restaurant closure I’ve seen, the owners had to pay the full remaining balance for hardware. Once all of your debts are paid and accounts are closed, remember to close your final account—your business bank account.

Step 9: Say Goodbye

Closing a restaurant for good is emotional. Even if the most recent years or months were stressful, you also have years of your life and many memories tied up in the location, the menu, and even the furnishings. Give yourself time to process the beginning of a new chapter in your personal and professional life. And remember, plenty of recognizable restaurant owners have closed restaurants, from Thomas Keller to David Chang. Closing a restaurant business is not a sign of failure, it is simply ending one phase of your professional life and moving on to something new.

Alternatives to Closing Your Restaurant

If you aren’t sure you have reached the point of restaurant closing, there are some alternatives to consider. Popular alternatives to closing your restaurant for good are:

Develop a New Concept

If you have a good location that you own (or a favorable lease) and you have energy for the restaurant business, but know you need to make some changes, developing a new concept for your restaurant is a great option. Would changing your menu, price point, decor, or beverage program move the needle enough to keep you in business?

A good example of reconceptualizing a restaurant comes from celebrity chefs Susan Feniger and Mary Sue Milliken. They closed their full service Santa Monica restaurant Border Grill and reopened a few months later as Socalo, a lightened-up, California-style pan-Latin concept with a robust catering plan. Reconceptualizing also works for non-celebs; Vermont’s Trail Break Cafe opted to relocate its brick-and-mortar location and lean more heavily on catering to drive sales, save managerial bandwidth, and retain staff.

Give the Business to Family

If your restaurant business is relatively healthy and you have family members who are eager for the challenge, turning over the business to interested family members could be a great option. Even if you have family members who don’t seem eager, ask; some people may not feel comfortable asking for your business if you appear to love it.

Passing the torch to family makes perfect sense for Dayton, Ohio restaurant Jimmies’ Ladder 11. Founder Jimmie Brandell recently decided to retire and passed the restaurant ownership to his son, Nick. Giving a beloved business to family members can help stave off feelings of loss when you move on yourself.

Sell the Business to Employees

Worker-owned cooperatives are rare in the restaurant industry, but are increasingly popular. Selling to workers is a real possibility if your restaurant is staffed with passionate employees and isn’t too large an operation. Test the waters by asking if your staff is interested in ownership. If they are, give them the chance to meet and make an offer. You should also only need to break even or make a small profit on the sale; selling to your staff is about preserving a legacy business, not gouging your buyers.

If you’re interested in learning more about selling your restaurant to the employees, check out how Seattle-based Jude’s Old Town restaurant made it work. A cooperative of 10 worker-owners have run this neighborhood spot since 2022. With a 4.5 rating on Yelp, it looks like they’re doing all right.

Last Bite

Whether you sell or liquidate, closing your restaurant for good is a big move. You can help yourself know when the time comes by deciding in advance what events might force a closure. Once you’ve decided to close, you’ll need a few months to a year to pay all your outstanding taxes and vendor balances and file the appropriate paperwork to dissolve your business in the eyes of the state. Take the time to notify staff and customers to give your community and yourself time to say goodbye to a beloved neighborhood spot and—if you’ve opted to sell—to introduce the new owners.

Plenty of successful restaurants close for various reasons. A closure is not a failure, it is a sign that you are starting a new chapter in your professional journey.