Mobile bartenders travel to different locations to serve alcohol at one-time and temporary events, like weddings, festivals, and corporate parties. Whether you bartend independently or as part of a restaurant or catering job, it is important to protect yourself and your bartending business. Mobile bartending insurance is designed to protect bartenders and businesses that serve […]

Mobile bartenders travel to different locations to serve alcohol at one-time and temporary events, like weddings, festivals, and corporate parties. Whether you bartend independently or as part of a restaurant or catering job, it is important to protect yourself and your bartending business. Mobile bartending insurance is designed to protect bartenders and businesses that serve alcohol outside of a traditional bar or restaurant.

Key Takeaways:

Mobile bartenders insurance is a specialized business insurance policy that protects you from the unique risks that come from running a mobile bar business. Traditional bartenders work in a fixed location and are typically employees of a venue that has multiple types of insurance coverage. Mobile bartenders tend to be solo entrepreneurs and also operate at multiple venues they do not own, which introduces a whole new set of risks.

Mobile bartenders insurance can cover your business all year or only on singular events. The coverage you need will vary based on a few variables:

Your mobile bartender’s insurance policy typically includes:

“Just don’t tell the insurance company you’re working.”

In online forums, you’ll see some business owners and even other mobile bartenders advising others not to bother with commercial auto insurance. “Just don’t tell the insurance company you were working,” is what they say. This is insurance fraud. And it is incredibly easy for insurance adjusters to see when you’re not truthful; especially if the accident involves another person. Whatever you spend on commercial auto coverage will be less than the cost of replacing your vehicle, or equipment, or losing your business.

In many states, bartenders can be charged with felonies or misdemeanors for overserving customers, serving obviously intoxicated people, or serving minors. In some places, bartenders can even be charged if a customer they served later gets in an accident and damages property or injures someone.

Mobile bartenders insurance can help bartenders settle claims from these incidents provided you did not knowingly serve someone obviously intoxicated. Mobile bartenders also have liabilities associated with their equipment and the client’s property.

Imagine you are hired to bartend an outdoor wedding. One of the guests trips over a box of your backstocked alcohol. They break their arm and sue you for the medical expenses. Without mobile bartending insurance, you could be on the hook for the costs of defending your business, plus the customer’s medical costs. If you accidentally serve someone underage who used a fake I.D., your mobile bartending insurance would also protect you.

It is important to note that mobile bartending insurance only protects you and your business from accidents and the unexpected. If you knowingly serve minors or over-serve a client who is already intoxicated, your policy will likely not cover you if there is an accident or property damage.

Specialty Mobile Bartenders Coverages

While most mobile bartenders need general liability coverage and liquor liability, you may also need additional coverage based on the bartending services you provide. Some additional coverage might include:

Like your overall coverages, how much your mobile bartenders insurance costs will vary based on your location, the services you provide, and the number of events you book. If you plan for between $300 to $1,500 per year for a comprehensive policy, you’re unlikely to be surprised.

A single mobile bartender who books a few events a month can expect to spend around $500 annually for their mobile bartending policy. However, the costs will be higher for bartenders who provide more equipment, like bar tops, cocktail tables, and glassware.

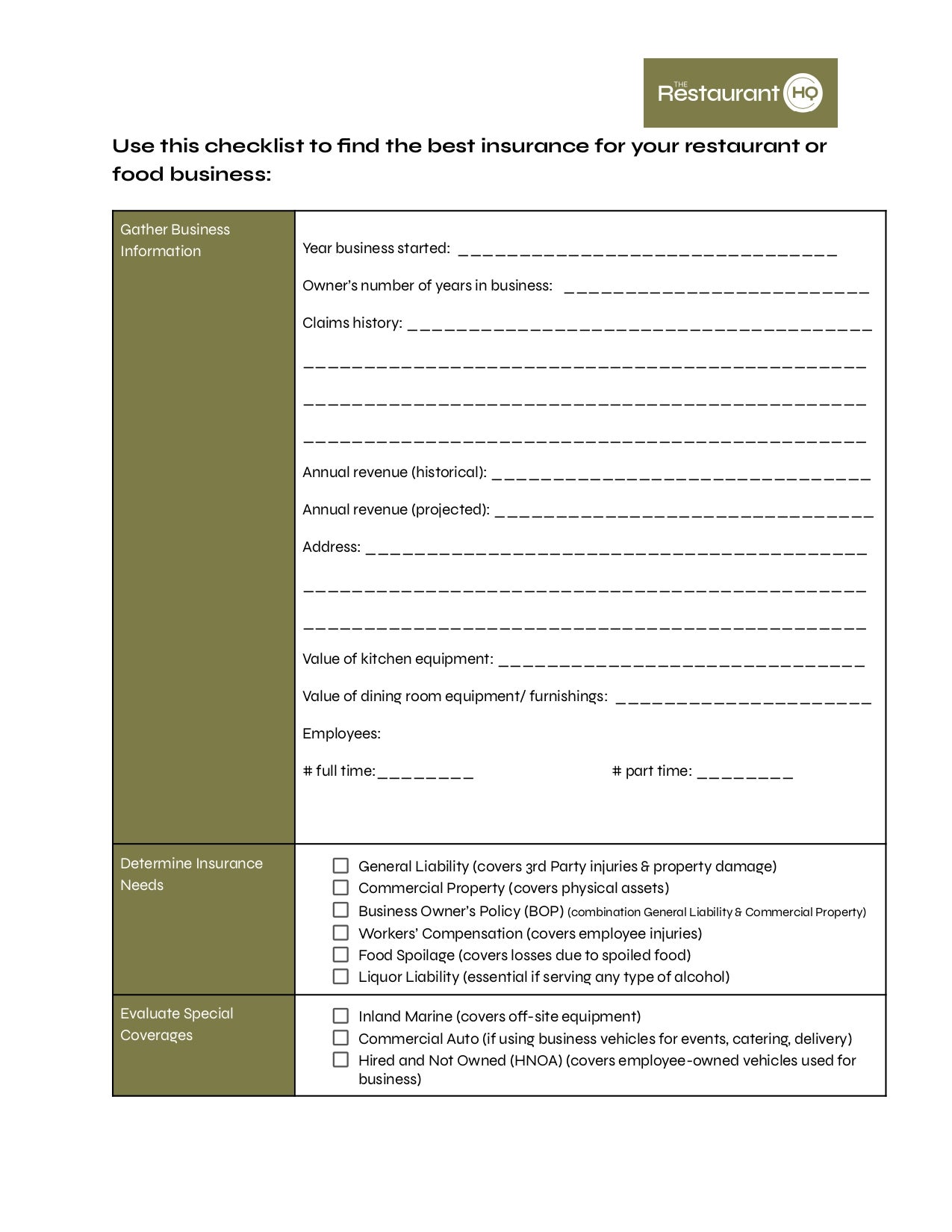

Choosing the right mobile bartending policy involves evaluating your risks and understanding the coverage you need. If you’re in the market for a mobile bartending policy, follow these steps:

Speed up your search by comparing several providers head to head with our downloadable comparison checklist.

Use this checklist to compare insurance coverage quotes from multiple insurers.

Mobile bartenders insurance has a few variables. These are the most common questions I get from mobile bartenders looking for insurance.

Many states require mobile bartenders to have insurance coverage. Even if your state or country doesn’t require mobile bartenders insurance at a legal level, many private event venues will require you to have insurance before approving you as a vendor. This is especially true for venues that do not serve alcohol themselves. High-end venues (where you can book clients with higher budgets) may also ask to be listed as an additional insured on your policy; so check with your insurance provider to ensure your coverage can extend.

Your mobile bartenders insurance will be tied to the location where you typically operate. So whether your policy covers operations across multiple states will depend entirely on your particular policy. If you operate in multiple states—or want the option to accept events in other states—talk to your insurance provider about this. It is better to be covered before you accept a bartending job than to risk operating without insurance.

You can get one-day mobile bartender’s insurance. This is great for one-off events, and ideal for bartenders who typically work in a brick-and-mortar bar and book the occasional offsite gig. Single-day mobile bartenders insurance can cost $100 or more for a single day. Depending on your business size, a policy that covers you all year might only be $300 to $500. So if you book more than three bartending events a year, a full policy will be more cost-effective and give you the opportunity to accept more business.

Mobile bartender’s insurance is an essential investment in your bartending business. It protects you from accidents and oversights. Whether you’re just starting out or you’ve been bartending for a while, mobile bartenders insurance can give you peace of mind so you can focus on booking clients with your memorable cocktails. But remember, mobile bartenders insurance only protects you if the unexpected happens. It’s on you to know local liquor serving laws and stick to them.

Mary King is a veteran restaurant manager with firsthand experience in all types of operations from coffee shops to Michelin-starred restaurants. Mary spent her entire hospitality career in independent restaurants, in markets from Chicago to Los Angeles. She has spent countless hours balancing tills, writing training manuals, analyzing reports and reconciling inventories. Mary has been featured in the NY Post amongst other publications, and in podcasts such as Culinary Now where she discussed starting your first restaurant, how to leverage your community and avoiding technology traps.

Property of TechnologyAdvice. © 2026 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this site are from companies from which TechnologyAdvice receives compensation. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. TechnologyAdvice does not include all companies or all types of products available in the marketplace.