Mobile bartenders travel to different locations to serve alcohol at one-time and temporary events, like weddings, festivals, and corporate parties. Whether you bartend independently or as part of a restaurant or catering job, it is important to protect yourself and your bartending business. Mobile bartending insurance is designed to protect bartenders and businesses that serve alcohol outside of a traditional bar or restaurant.

Key Takeaways:

- Mobile bartenders insurance covers bartending businesses that travel to provide service at offsite locations.

- If you bring your own bartending equipment, you can get that insured for onsite service or while in transit from place to place.

- Mobile bartender’s insurance won’t cover claims resulting from negligence, so make sure you’re operating within local laws.

What Is Mobile Bartenders Insurance?

Mobile bartenders insurance is a specialized business insurance policy that protects you from the unique risks that come from running a mobile bar business. Traditional bartenders work in a fixed location and are typically employees of a venue that has multiple types of insurance coverage. Mobile bartenders tend to be solo entrepreneurs and also operate at multiple venues they do not own, which introduces a whole new set of risks.

Mobile bartenders insurance can cover your business all year or only on singular events. The coverage you need will vary based on a few variables:

- How often you bartend: Mobile bartending policies are available for full-time coverage or short-term coverage, as short as a single day.

- The venues you work with: Like most business insurance, mobile bartending insurance is tied to your operating location or locations. If you work with venues in different states or counties, your coverage needs will increase.

- What type of alcohol you serve: Mobile bartenders who specialize in beer and wine service have fewer risks than bartenders offering full bar service with an array of liquor and spirits. Serving pre-made bottled beverages of any kind is also less risky than mixing drinks to order with fresh ingredients (any of which could be a vector for food-borne illness).

- What equipment you provide to your clients: Any equipment you bring with you to an offsite event could be lost or damaged, or cause an accident for a customer. If you provide glassware, a mobile bar, even stir sticks and straws you’ll need additional coverage than a mobile bartender that does not provide these items.

- How you transport your equipment: If you take a personal vehicle to events—especially if you transport equipment in it—you’ll need coverage for the vehicle, too.

Your mobile bartender’s insurance policy typically includes:

- General liability: General liability covers your mobile bar business in the case of claims of loss, damage, or injury from clients and the general public. Depending on your bartending business type, your general liability policy may also include specific coverages written into the policy to cover the accidents you are most likely to encounter.

“Just don’t tell the insurance company you’re working.”

In online forums, you’ll see some business owners and even other mobile bartenders advising others not to bother with commercial auto insurance. “Just don’t tell the insurance company you were working,” is what they say. This is insurance fraud. And it is incredibly easy for insurance adjusters to see when you’re not truthful; especially if the accident involves another person. Whatever you spend on commercial auto coverage will be less than the cost of replacing your vehicle, or equipment, or losing your business.

Why Mobile Bartenders Insurance Is Important

In many states, bartenders can be charged with felonies or misdemeanors for overserving customers, serving obviously intoxicated people, or serving minors. In some places, bartenders can even be charged if a customer they served later gets in an accident and damages property or injures someone.

Mobile bartenders insurance can help bartenders settle claims from these incidents provided you did not knowingly serve someone obviously intoxicated. Mobile bartenders also have liabilities associated with their equipment and the client’s property.

Imagine you are hired to bartend an outdoor wedding. One of the guests trips over a box of your backstocked alcohol. They break their arm and sue you for the medical expenses. Without mobile bartending insurance, you could be on the hook for the costs of defending your business, plus the customer’s medical costs. If you accidentally serve someone underage who used a fake I.D., your mobile bartending insurance would also protect you.

It is important to note that mobile bartending insurance only protects you and your business from accidents and the unexpected. If you knowingly serve minors or over-serve a client who is already intoxicated, your policy will likely not cover you if there is an accident or property damage.

Specialty Mobile Bartenders Coverages

While most mobile bartenders need general liability coverage and liquor liability, you may also need additional coverage based on the bartending services you provide. Some additional coverage might include:

- Interstate coverage: If you operate on the border between states or counties, you’ll want to mention this to your insurance provider. Business insurance policies tend to be tied to a specific operational location. So if you pick up an event across state lines, you’ll need interstate coverage.

- Inland marine coverage: You might think this is only necessary for bartending on a boat, but you’d be wrong. Inland marine insurance covers your equipment while it is in transit. So if you transport bartending equipment like glassware, service bars, lighting, etc., your commercial property coverage may not cover it while transporting it from one location to another. An inland marine policy will ensure your equipment is protected between storage and service locations.

- Product liability coverage: Product liability protects you and your bartending business in the event that a drink you made or served causes bodily injury or property damage. With all the other coverages we’ve listed, product liability might seem like overkill. But if your customers ingest a product you serve or prepare, we always recommend product liability coverage.

How Much Does Mobile Bartenders Insurance Cost?

Like your overall coverages, how much your mobile bartenders insurance costs will vary based on your location, the services you provide, and the number of events you book. If you plan for between $300 to $1,500 per year for a comprehensive policy, you’re unlikely to be surprised.

A single mobile bartender who books a few events a month can expect to spend around $500 annually for their mobile bartending policy. However, the costs will be higher for bartenders who provide more equipment, like bar tops, cocktail tables, and glassware.

How to Choose the Best Mobile Bartenders Insurance

Choosing the right mobile bartending policy involves evaluating your risks and understanding the coverage you need. If you’re in the market for a mobile bartending policy, follow these steps:

- Assess your risks: Consider the types of events you typically book. What type of alcohol do you serve at them? What equipment do you provide? What are the typical hours you serve alcohol, and how many people do you typically serve? Be honest; your insurance coverage will be based on this information, so it is important that you are accurate.

- Contact multiple providers: Reach out to multiple providers directly, or work with an insurance broker who can secure multiple quotes and help advise you on the best options. You can contact most providers directly through their website. To find an insurance broker, ask other bartenders or bar businesses who they used.

- Compare providers: Overall price is the major consideration for most mobile bartenders. But you should consider more than just your costs. Does the provider offer all the coverage you need? Can they cover you in adjacent markets if your business expands? Is their customer service responsive on nights and weekends when you are most likely to have a bartending-related claim?

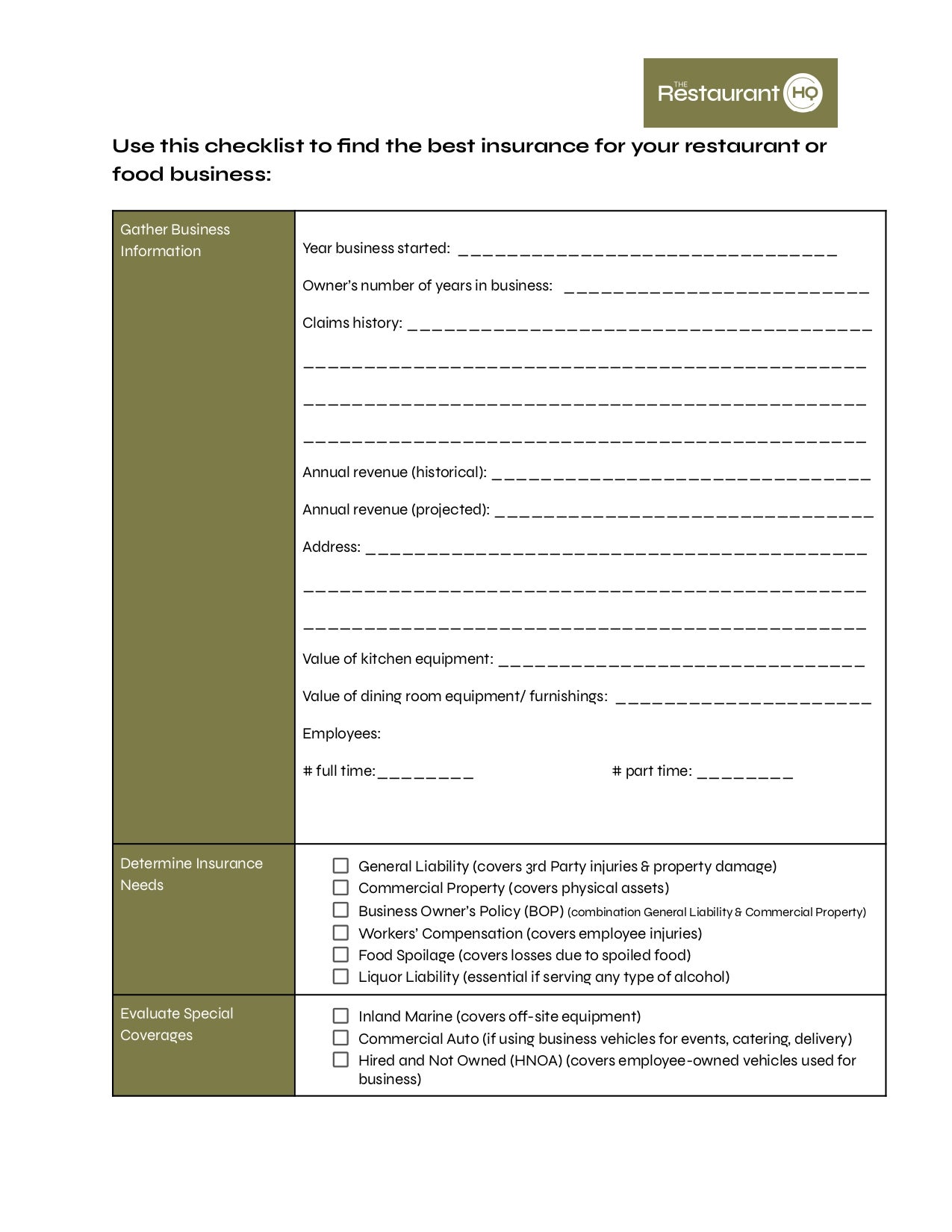

Speed up your search by comparing several providers head to head with our downloadable comparison checklist.

Mobile Bartenders Insurance Frequently Asked Questions (FAQs)

Mobile bartenders insurance has a few variables. These are the most common questions I get from mobile bartenders looking for insurance.

Last Bite

Mobile bartender’s insurance is an essential investment in your bartending business. It protects you from accidents and oversights. Whether you’re just starting out or you’ve been bartending for a while, mobile bartenders insurance can give you peace of mind so you can focus on booking clients with your memorable cocktails. But remember, mobile bartenders insurance only protects you if the unexpected happens. It’s on you to know local liquor serving laws and stick to them.

ALSO READ