Food delivery has become an increasingly significant part of the restaurant industry. Whether you’re a restaurant owner seeking to enhance your delivery strategy or looking to offer this service for the first time, these food delivery statistics provide valuable insights into the trends, preferences, and dynamics shaping this market landscape. Check out the following food […]

Food delivery has become an increasingly significant part of the restaurant industry. Whether you’re a restaurant owner seeking to enhance your delivery strategy or looking to offer this service for the first time, these food delivery statistics provide valuable insights into the trends, preferences, and dynamics shaping this market landscape.

Check out the following food delivery trends and statistics to help you understand the best approach.

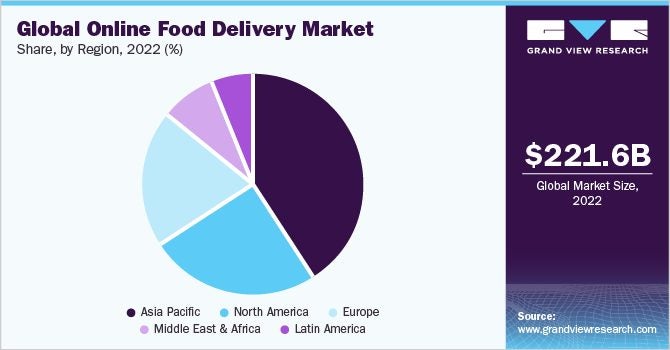

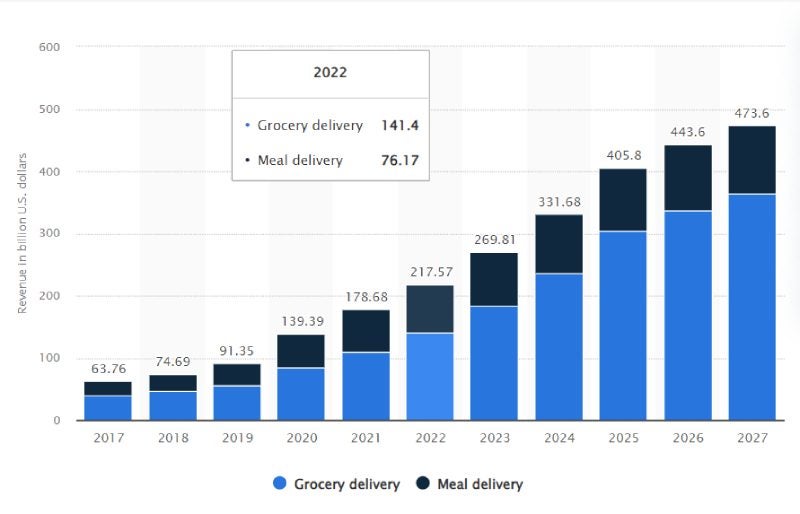

Globally, the online food delivery market is worth an estimated $221.65 billion in 2022. Its expected compound annual growth rate (CAGR) is 10.3% for 2023 through 2030. Many factors contribute to this growth, including internet and technology advancements and the rise of cloud kitchens, also known as ghost kitchens.

The US delivery market was estimated at $218 billion in 2022. The only food delivery market that is larger is China. This figure includes all food delivery businesses, not just food delivery that is ordered online. It also includes delivery from food service businesses, from restaurants to meal delivery services and groceries.

Meal delivery itself is big business, too. Brands like HelloFresh that deliver meal kits are seeing a surge alongside restaurant food delivery. These services are not only for big, nationwide corporations, though. Small, local businesses like restaurants and caterers can also get into the meal delivery game.

As of January 2022, the most popular food service platforms included:

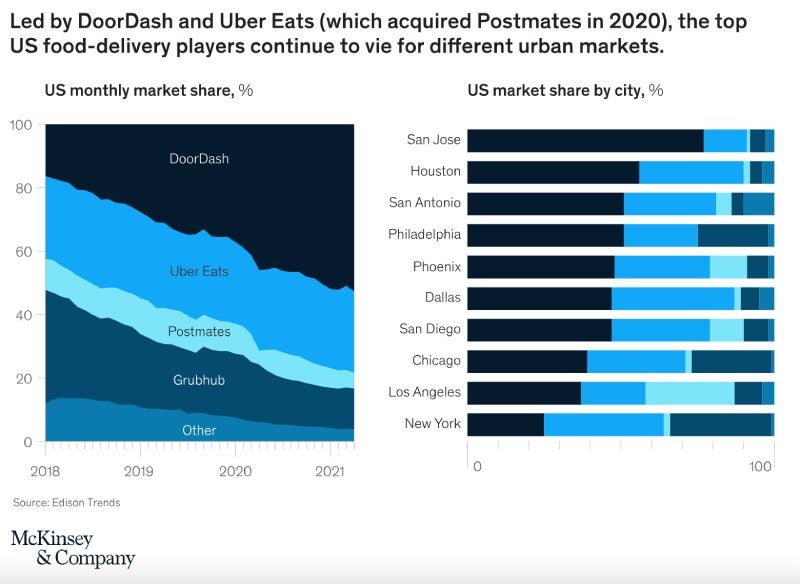

In the US, DoorDash, Grubhub, Postmates, and Uber Eats dominate the food delivery market. The top platforms vary depending on location. DoorDash has market dominance in San Jose, for example, while it competes more closely with Uber Eats and Grubhub in New York City.

Consider user demographics in your area when choosing which platforms to go with. It’s worth exploring the top food delivery platforms to see which is viable for your business. Each has its own user base and fee structure.

Related: Third-party Delivery Services: Pros/Cons & How They Work

When it comes to trust and reliability, more than a third (37%) of consumers believe the best way to order food delivery is through a third-party delivery app like Deliveroo, JustEat, Seamless, and those mentioned above. These people think apps provide the best value and experience.

Similarly, 35% of consumers think that ordering from the restaurant directly is the best way to get a quality and reliable experience. These data points make a strong case for putting your restaurant on third-party delivery apps as well as offering the service to customers directly.

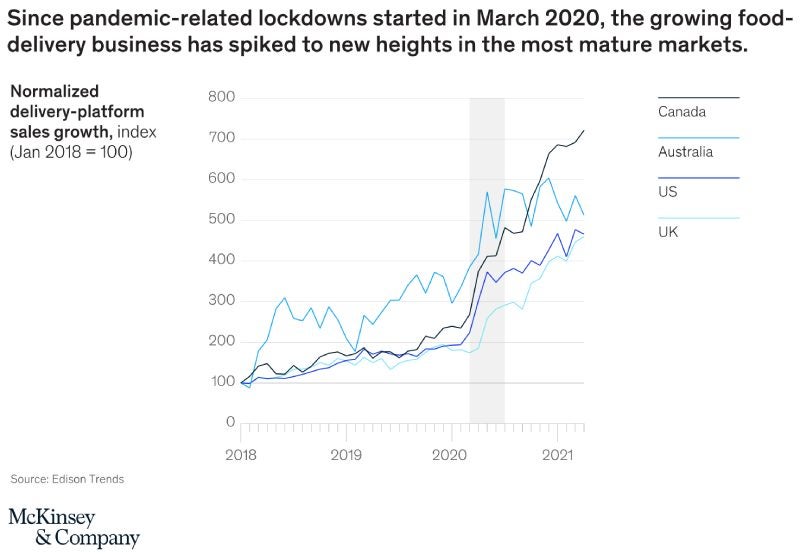

Before the COVID-19 pandemic in 2020, food delivery services were growing about 7%–8% each year—compared to 3%–4% annually for restaurants overall. Much of this growth was fueled by millennial and Gen Z consumer preference for the convenience of prepared meals. Many restaurants would benefit from focusing on younger demographics in their targeting and marketing.

When the COVID-19 pandemic hit the globe, food delivery services experienced a surge in growth, peaking during the most severe lockdown periods. Globally, Australia experienced the most growth.

Third-party food delivery platforms and apps monetize their services in five key ways:

It’s important to keep an eye on fees you’ll need to pay when evaluating different third-party food delivery platforms.

On average, food delivery platforms will charge restaurants a commission fee of anywhere from 15% to 30% of the order total. This is a decent-sized commission that impacts restaurants’ profit margins. Remember to account for this expense in your pricing strategy. Many restaurants actually charge more for delivery on third-party apps than if customers were to order directly or dine in.

On average, food delivery service customers pay $2 to $5 per order in delivery fees. These fees don’t come out of the restaurant’s profit.

Customers also pay a service fee for each order. This is an average of 15% of the order total. Again, these fees don’t impact the restaurant’s profit.

Roughly 57% of Americans prefer to order delivery or takeout, while 43% prefer to dine in at restaurants. Many businesses offer both options to capture both segments.

Consumers prefer ordering delivery or takeout for five main reasons:

The 10 most popular restaurant types for ordering takeout or delivery include:

A number of studies indicate widespread use of food delivery. A 2023 study found that nearly 79% of Americans report using food delivery services annually. According to another, approximately 17% of US consumers use online food delivery services at least monthly. And a further 5% use a delivery service like Blue Apron or HelloFresh at least monthly.

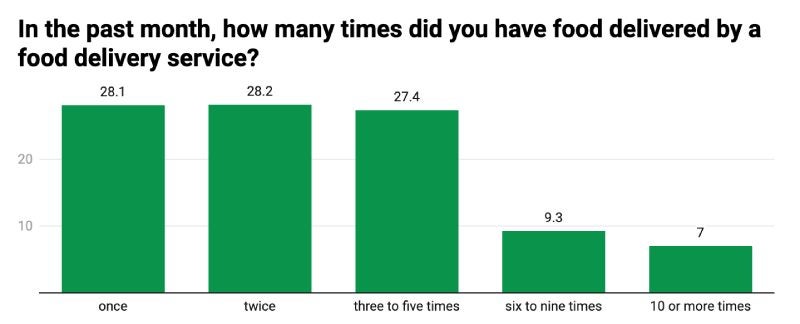

Of those who use food delivery services, more than half—56.3%—use the service once or twice a month. More than a quarter use it three to five times each month, 9% use it six to nine times, and 7% order food delivery at least 10 times each month.

Meal kits are a steady form of food delivery, using parcel delivery services rather than last-mile delivery by car, bike, or courier. A number like 5% may not seem like a lot of the dining public, but most meal delivery services are subscription-based, so the business tends to be steady.

Most consumers opt for ordering delivery when it comes to dining from restaurants, with 77% reporting they’ve ordered food for delivery compared to 76% who have ordered takeout for pickup and 61% who have dined in at a restaurant. More than 80% say they ordered takeout and delivery the same amount or more in 2023 compared to 2022.

The average age for food delivery service users is 21.8 years old. If you’re looking to boost your delivery business, you can reach these younger diners by offering delivery services at an affordable price and touting any sustainability initiatives your business supports. More than any other generation, Gen Z shoppers tend to be environmentally conscious.

Customers in their 20s say they rely on food delivery service apps about 1.8 times each week. This could mean steady business for your restaurant if you can lock in that customer base.

For consumers who use food delivery services, 27.6% “usually” or “always” order from restaurants. Comparatively, 18% order from fast food establishments, and 10.9% order from convenience stores.

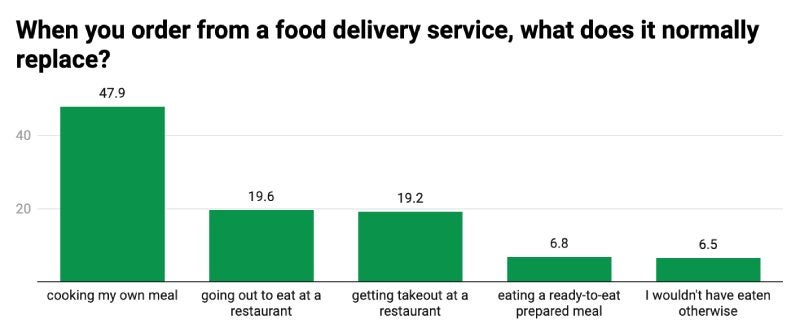

Of those who use food delivery services, 47.9% say they do so in order to replace having to cook their own meal. This is another data point supporting the idea that your delivery menu should focus on affordable, weeknight dishes. There’s a reason the delivery apps are full of burger joints, barbecue joints, and pizzerias. These are all dishes that are affordable, customizable, and travel well.

Without food delivery services, 6.7% of consumers say they probably wouldn’t have eaten otherwise. Food delivery services are providing an important part of people’s overall health and wellness. Consider offering healthy options and being proactively transparent about nutritional information for these particular customers.

Another of the top food delivery trends isn’t just ordering for oneself but ordering for others. Though most people (79%) cook when they host guests for a meal, 40% have ordered delivery and 24% have picked up takeout. Restaurants may consider offering dishes in large sizes or family-style versions to cater to these types of customers.

In one survey, American consumers reported spending an average of $35.42 per food delivery order. When you compare this to in-house dining, it can be a lot more. For example, restaurant institution Olive Garden reports an in-house check average of $22.50 for 2023. Of course, some of that $35.42 accounts for delivery fees, so customers may be spending more for delivery while still spending the same basic amount at your restaurant. But this number indicates that customers understand delivery costs a little bit more (so they may as well add an extra side of fries, right?).

A further 37.1% report tipping 15% for delivery. So the majority of American consumers expect to pay a little extra for the convenience of delivery. Only 2.1% report not tipping at all when they order food for delivery.

When ordering food delivery, more than two-thirds of consumers prioritize ordering food that tastes good and has yummy ingredients. This is especially important if they’re watching their budget. Comfort food—from pasta to burritos—is a surefire winner for these customers.

On a similar note, two-thirds of delivery service users make their ordering decisions based on the overall quality of the restaurant itself. Quality can mean a lot of different things to customers, but generally, you can expect your health code rating and star ratings on Google, Yelp, and TripAdvisor to impact customer perceptions of your restaurant’s quality.

Piggy-backing on the previous item; when vetting their food orders, 59% of customers also check out customer reviews and restaurant ratings. Social proof is very important to food delivery customers.

Menu variety plays a smaller but still important role in customers’ decisions for food delivery. As many as 27% of consumers seek out a varied menu with lots of different choices. Which makes sense if you’ve ever tried to order a single delivery meal for a family of four. When everyone wants something different, you can make it easy for customers to choose your restaurant by offering a wide range of dishes. Just keep in mind that you need to keep the quality of each dish in mind and make sure everything from your appetizers to desserts is delicious.

Check out these resources to help create your menu:

According to DoorDash, the top five most-ordered dishes in 2022 included:

These dishes all have a reputation for being affordable and tasty.

Another factor for customer retention is how quickly orders are received. As many as 32% of customers would opt for one restaurant over another if it offers a faster delivery window, and 41% of customers would likely order delivery from a restaurant again if they have received their order in a “quick, streamlined” fashion. How fast is fast? Well, 21–30 minutes is an acceptable time frame for 38% of customers.

Food delivery comes in handy when people are in urgent or last-minute need of food. About 73% of consumers say they’ve ordered delivery for “an urgent situation.” This is more likely to happen for Gen Z and millennial customers, who say this happens at least a few times a week. Capture these customers by offering fast delivery options.

Customer retention is important for every small business. When it comes to food delivery, the quality of the meal itself is the biggest influence on whether or not a customer will order from a restaurant again in the future—at least according to 52% of consumers.

Quality and efficiency are important, and so is food temperature. In fact, the order arriving at the right temperature is enough to influence 31% of customers to order from the restaurant again in the future.

Nearly 80% of food delivery customers have had an issue in the past with at least one of their orders. The top five issues they’ve faced include:

In the event there is an issue with their order, 93% of customers would like to receive a phone call, regardless of what the issue is.

If a driver needs help, such as locating the customer’s home, most people (59%) prefer to receive a direct phone call.

Nearly three-quarters of drivers “always” or “usually” need to communicate directly with customers. When this happens, they’ll resort to making a phone call 25% of the time.

Even though most customers prefer to receive a phone call if there’s an issue with their order, more than 60% have missed a call in the past. And 69% of drivers report their call has been ignored because the customer didn’t know who was calling. For 56% of people, this missed communication has led to a negative customer experience.

To mitigate these missed calls, 68% of customers said they would switch to a delivery service that’s able to identify its own phone calls.

Food delivery is likely to remain popular across the country for the foreseeable future. Delivery chains will become increasingly efficient, and large chains and institutions will innovate to reduce the cost (both environmentally and monetarily) of last-mile, on-demand delivery. We’re already seeing massive innovation with food delivery technology Starship rolling out food delivery robots on college campuses and residential communities.

Already every modern, cloud-based restaurant point of sale (POS) system includes some built-in delivery management software. Many support Uber-like delivery driver management that allows you to route a team of in-house drivers and track their tips for payroll. In years to come, these systems will get more efficient and less expensive, putting robust delivery tools in the hands of even the smallest restaurants.

Here are some of the most common questions people have about food delivery statistics.

An overwhelming majority of Americans order food delivery. Most studies find that up to 78% of consumers report using some kind of food delivery service every year, and many (from 17% to 56%, depending on who you ask), report ordering food delivery every month.

No, people are not ordering less good delivery. Consumers continue to use food delivery to avoid cooking for themselves or for guests.

Globally, the online food delivery market size is valued at $221.65 billion. In the US, the second-largest food delivery market in the world, revenue was estimated at $218 billion in 2022—though this includes data from food service businesses, including meal and grocery delivery services.

These food delivery stats tell one story: It’s a business model that’s here to stay, and one worth exploring if you’re a small business restaurant owner. If you can employ the tools and technology needed to create an excellent customer experience, you can use food delivery to drive customer acquisition and retention in a cost-effective way for years to come.

Mary King is a veteran restaurant manager with firsthand experience in all types of operations from coffee shops to Michelin-starred restaurants. Mary spent her entire hospitality career in independent restaurants, in markets from Chicago to Los Angeles. She has spent countless hours balancing tills, writing training manuals, analyzing reports and reconciling inventories. Mary has been featured in the NY Post amongst other publications, and in podcasts such as Culinary Now where she discussed starting your first restaurant, how to leverage your community and avoiding technology traps.

Property of TechnologyAdvice. © 2026 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this site are from companies from which TechnologyAdvice receives compensation. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. TechnologyAdvice does not include all companies or all types of products available in the marketplace.