The best restaurant payroll software helps restaurant operators and managers process employee salaries accurately and on time while offering tools to manage payroll taxes, monitor attendance, and track tips.

It must also be easy to use, have good client support, and efficiently handle the complexities of paying restaurant staff. Pricing is also important, especially for small establishments, so a reasonably priced plan with unlimited payroll runs is ideal. Scroll through my evaluation of the eight best restaurant payroll services to find your next solution or see how your current solution stacks up.

- Square Payroll: Best for bars and cafes using Square POS

- Gusto: Best restaurant payroll software for essential features

- QuickBooks Payroll: Best for hiring contractors

- Homebase Payroll: Best for hourly workers

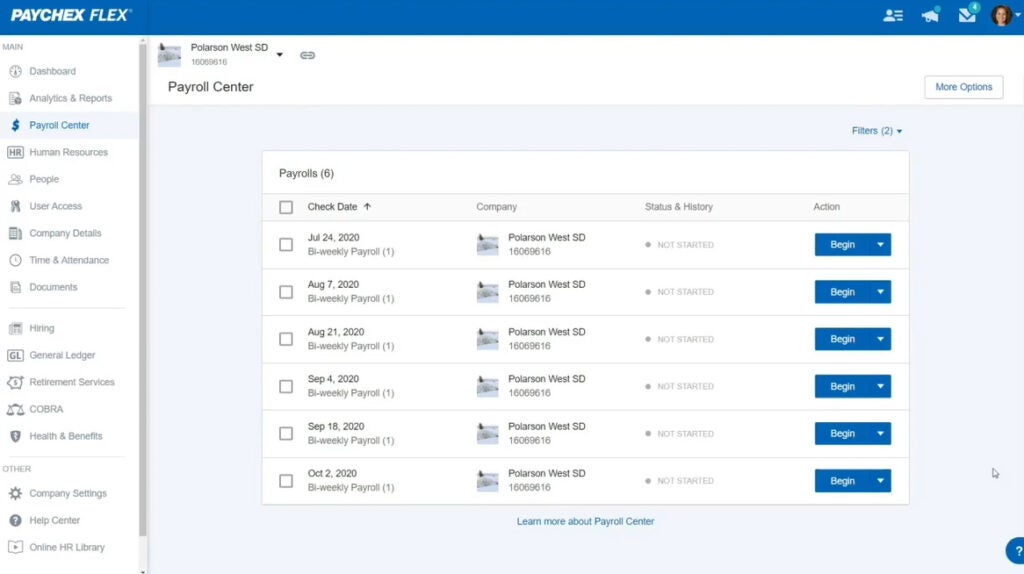

- Paychex: Best for restaurants needing expert payroll support

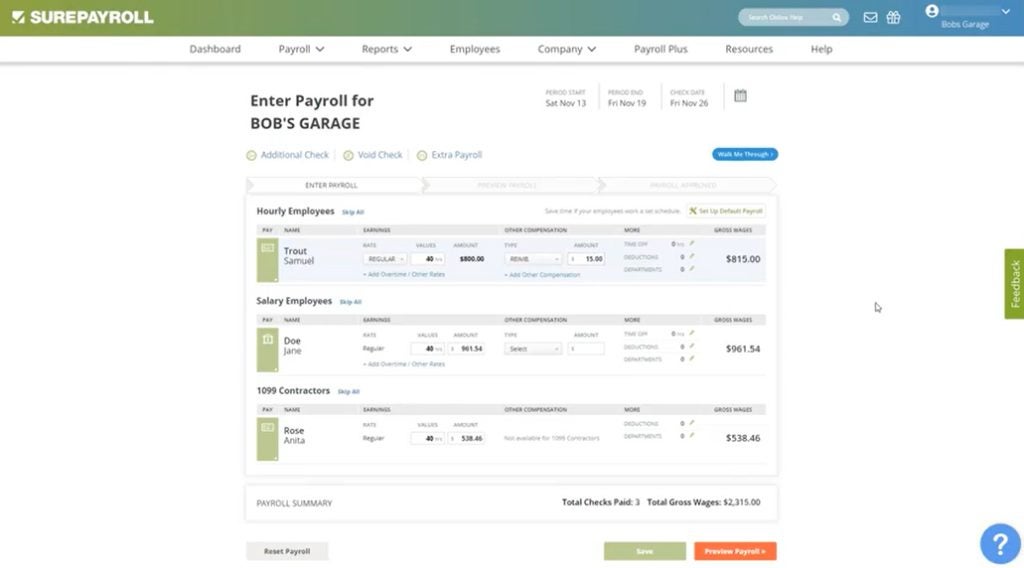

- SurePayroll: Best affordable payroll for DIY taxes

- OnPay: Best for client support and delegating payroll tasks

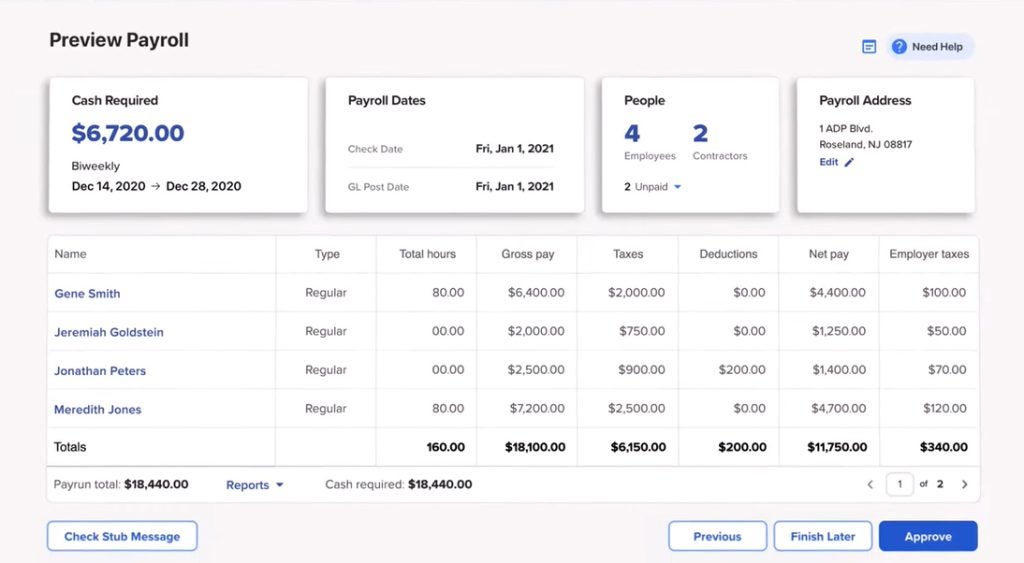

- ADP Run: Best for scaling fast-growing restaurant businesses

Best restaurant payroll software compared

| My score | Starting monthly price | Special contractor-only payroll | Multistate payroll | Health benefits available in 50 states | |

| 4.64/5 | $6 per employee + $35 base fee | $6 per contractor monthly | ✓ | ✓ |

| Visit Square Payroll | |||||

| 4.51/5 | $6 per employee + $49 per month | $6 per contractor + $35 base fee monthly | Included in higher tiers | ✓ |

| Visit Gusto | |||||

| 3.96/5 | $6 per employee + $50 per month1 | $15 monthly for 20 contractors; plus $2 per additional worker | ✓ | ✓ |

| Visit QuickBooks Payroll | |||||

| 3.85/5 | $6 per employee + $39 base fee2 | ✕ | ✓ | ✕ |

| Visit Homebase Payroll | |||||

| 3.84/5 | $5 per employee + $39 base fee3 | ✕ | ✓ | ✓ |

| Visit Paychex | |||||

| 3.81/5 | $4 per employee + $20 base fee4 | ✕ | ✓ | ✓ |

| Visit SurePayroll | |||||

| 3.81/5 | $6 per employee + $49 base fee | ✕ | ✓ | ✓ |

| Visit OnPay | |||||

| 3.76/5 | $81.66 weekly to pay 25 workers + $1.89 per additional worker5 | ✕ | ✓ | ✓ |

| Visit ADP Run | |||||

1At the time of this writing, QuickBooks was promoting 90% off for three months, for a starting price of $5 per month plus $6 per employee per month.

2Homebase’s payroll features are only available as an add-on for the price above. Homebase plans range from $0 to $120 per month per location.

3Based on third-party sources

4Doesn’t include tax filings

5Based on a quote I received for ADP Run’s Enhanced plan.

Square Payroll: Best for bars and cafes using Square POS

Pros

Cons

Gusto: Best payroll software for restaurants with essential features

Pros

Cons

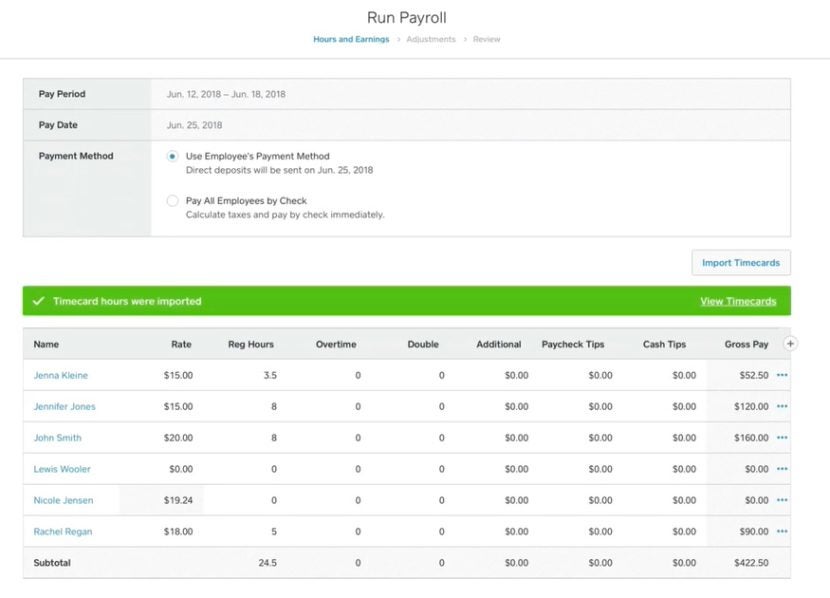

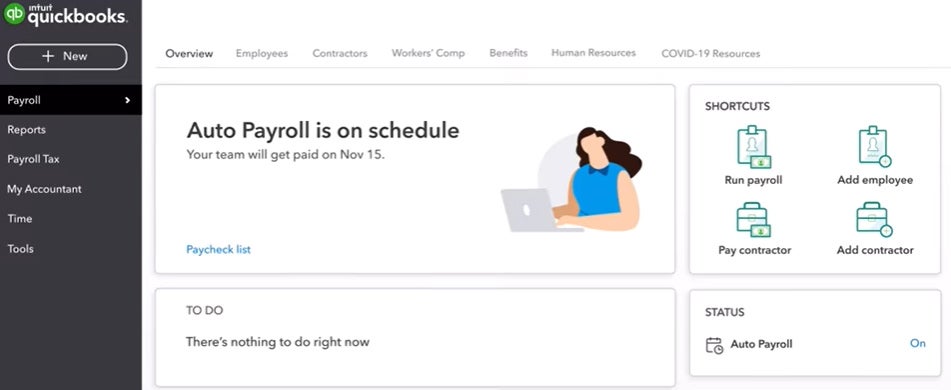

QuickBooks Payroll: Best for independent operators paying contractors

Pros

Cons

Homebase Payroll: Best for hourly workers

Pros

Cons

Paychex: Best for restaurants needing expert payroll support

Pros

Cons

SurePayroll: Best for affordable payroll for DIY tax filings

Pros

Cons

OnPay: Best for client support & delegating payroll tasks

Pros

Cons

ADP Run: Best for scaling fast-growing restaurant businesses

Pros

Cons

How I evaluated the best payroll software for restaurants

I compared 14 reputable payroll providers that, apart from processing employee payroll, offer attendance management and restaurant-specific solutions, such as time tracking and tip reporting. I rated each on a five-star scale designed to assess restaurant payroll services, narrowing my list to the top eight.

- Pricing (20%): I looked at the monthly implementation costs, processing costs, setup, and year-end fees. Payroll providers with plans priced less than $50 for one employee were rated more favorably since they’re budget-friendly. I also considered whether each provider has transparent pricing, multiple plan options, and unlimited pay runs.

- Restaurant-specific features (15%): Time tracking features, tipped minimum wage features, tip reporting features, and POS integrations are incredibly important for restaurant owners and can play a huge role in finding the payroll provider that is right for them.

- Payroll features (15%): Automatic payroll runs, payroll tax filing, 1099 form preparation, manual check capabilities, and two-day direct deposits are some of the features that I consider essential payroll services. Providers also get a point if they offer attendance monitoring and restaurant-specific solutions, such as tracking employee time-ins and outs, plus managing tips.

- Expert review (15%): In this criterion, I use my expert opinion to assess whether the software’s ease of use and the width and depth of its payroll and HR tools are ideal for small business owners.

- Ease of use (15%): In addition to having a user-friendly and intuitive platform, payroll software that integrates with common POS and third-party systems is awarded extra points. Given that restaurants operate on weekends, I also prioritized providers that offer live phone support and a dedicated representative.

- HR features (10%): One of the top criteria is having access to a professional who can provide expert advice on compliance issues, including new hire state reporting and online onboarding. Following closely behind these is the capability to provide employee benefits plans and a self-service portal that allows your staff to view payslips and access tax forms online.

- Popularity (5%): I considered user reviews based on a 5-star scale; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.

- Reporting (5%): Restaurants benefit more from customizable reporting tools, as they can easily create their own reports. Hence, providers that offer this functionality get extra points. Additionally, those that offer a selection of basic payroll reports are prioritized.

How to choose the best restaurant payroll software

Not all payroll software will be right for your restaurant business. When thinking about payroll options, consider your budget against the software’s scalability, support availability, and more.

- Budget: Budget may not be an issue if you are a large chain restaurant. However, keeping restaurant labor costs down will be essential for running a small cafe or restaurant. Consider an affordable payroll software that offers a wide range of options.

- Scalability: As your restaurant business grows, so should your payroll software. ADP offers the best scalability on my list; however, others may provide the tools you need as your company and employee base grow.

- Legal compliance: Software that handles tax processes for you is ideal. This ensures that the proper taxes, including tip tax, are taken out of each paycheck and reported to the correct government.

- Support: Having a dedicated representative may be key, especially for small restaurants. Make sure that the provider you use offers at least fast email communication. Phone and live chat support are ideal.

- Integration: Most restaurants use POS systems for customer payments. Payroll software that integrates with or includes POS systems (like Square) can help streamline your processes.

- Time management: Software that helps you manage employee schedules and time off, as well as payroll, will allow you to bring recorded time into your payroll for accurate processing.

- Ease of use: Due to the sensitive nature of payroll management, it’s in your restaurant’s best interest to have payroll software that is easy and efficient to use. This gives your key stakeholders confidence and ensures your practices are compliant and on time.

The restaurant payroll services I reviewed offer tip payment processing, tax filing services, year-end tax reports, and full-service payroll for employees and contractors.

Frequently asked questions (FAQs)

The last bite

When looking for software that processes employee salaries and taxes, it’s important to consider whether it has industry-specific payroll features that fit your business’s requirements. For restaurants, you need a solution that offers payroll and tax processing, time tracking, HR support, and tip reporting functionalities to help restaurateurs maintain compliance. Platforms should also be affordable if you’re running small restaurants.

For these reasons, I chose Gusto as a top restaurant payroll software. It provides the greatest balance among features and offers a variety of tools that address restaurants’ needs. It also has an intuitive platform and a budget-friendly full-service payroll option.