Looking for the best restaurant payroll software? My guide compares features and pricing for the top 8 solutions for paying workers, taxes, and tips on time.

The best restaurant payroll software helps restaurant operators and managers process employee salaries accurately and on time while offering tools to manage payroll taxes, monitor attendance, and track tips.

It must also be easy to use, have good client support, and efficiently handle the complexities of paying restaurant staff. Pricing is also important, especially for small establishments, so a reasonably priced plan with unlimited payroll runs is ideal. Scroll through my evaluation of the eight best restaurant payroll services to find your next solution or see how your current solution stacks up.

| My score | Starting monthly price | Special contractor-only payroll | Multistate payroll | Health benefits available in 50 states | |

| 4.64/5 | $6 per employee + $35 base fee | $6 per contractor monthly | ✓ | ✓ |

| Visit Square Payroll | |||||

| 4.51/5 | $6 per employee + $49 per month | $6 per contractor + $35 base fee monthly | Included in higher tiers | ✓ |

| Visit Gusto | |||||

| 3.96/5 | $50 per month + $6.50 per employee monthly | $15 monthly for 20 contractors; plus $2 per additional worker | ✓ | ✓ |

| Visit QuickBooks Payroll | |||||

| 3.85/5 | $6 per employee + $39 base fee2 | ✕ | ✓ | ✕ |

| Visit Homebase Payroll | |||||

| 3.84/5 | $5 per employee + $39 base fee3 | ✕ | ✓ | ✓ |

| Visit Paychex | |||||

| 3.81/5 | $4 per employee + $20 base fee4 | ✕ | ✓ | ✓ |

| Visit SurePayroll | |||||

| 3.81/5 | $6 per employee + $49 base fee | ✕ | ✓ | ✓ |

| Visit OnPay | |||||

| 3.76/5 | $81.66 weekly to pay 25 workers + $1.89 per additional worker5 | ✕ | ✓ | ✓ |

| Visit ADP Run | |||||

1At the time of this writing, QuickBooks was promoting 90% off for three months, for a starting price of $5 per month plus $6 per employee per month.

2Homebase’s payroll features are only available as an add-on for the price above. Homebase plans range from $0 to $120 per month per location.

3Based on third-party sources

4Doesn’t include tax filings

5Based on a quote I received for ADP Run’s Enhanced plan.

Pricing: 5/5

Restaurant-specific features: 5/5

Payroll features: 4.75/5

HR features: 4.5/5

Popularity: 2.5/5

Reporting: 5/5

Expert review: 5/5 Ease of use: 3.75/5

Who should use it

If you’re already using Square POS for your restaurant, adding Square Payroll is simple. It offers a low-cost full-payroll service that includes unlimited pay runs, automatic payroll tax calculations, tax filings and payments, and multiple pay options, such as direct deposit, check, and Cash App.

In addition, you get a better value if you use Square POS in your restaurant since this software integrates with it directly. Plus, you get free access to Square’s time card integration, allowing you to track employee attendance seamlessly and easily.

Why I like it

Score-wise, I gave Square Payroll an overall rating of 4.6 out of 5. Based on my evaluation criteria, the software’s standout features are its affordable flat-rate pricing and robust payroll functionalities, which include tip management and reporting.

You can import credit card tips from the Square POS and let its restaurant tip-out functionality pool and split the amount among employees based on the number of hours worked in a pay period.

However, Square’s payroll and customer support are only available by phone and email on weekdays, from 6 a.m. to 6 p.m. Pacific time. In addition, if you’re not yet a Square client, speaking to a customer representative may be difficult because of the occasional long wait times.

Users also like Square. Although reviews were much lower than typical, Square Payroll scored above a 4 out of 5 across the board. Users like the integration with its POS product, how simple it is to convert time cards into payroll, and automated tax processing.

When to use an alternative

If you aren’t a Square user but still want fast payments, try QuickBooks Payroll. It offers next-day direct deposits and even a same-day option, provided you get its higher tiers. Gusto, Paychex, and ADP are good alternatives if you’re looking for full-service payroll with a wide suite of HR solutions to manage the entire employee lifecycle.

Full-service payroll: $35 + $6 per employee monthly

Contractor-only payroll: $6 per contractor monthly

Pricing: 4/5

Restaurant-specific features: 5/5

Payroll features: 4.25/5

HR features: 4.88/5

Popularity: 5/5

Reporting: 5/5

Expert review: 5/5 Ease of use: 3.88/5

Who should use it

Gusto has all the essential features for paying restaurant staff, calculating and filing payroll taxes (federal, state, and local), tracking attendance, managing benefits, and onboarding employees, making it my top pick overall.

It can generate and file W-2 and 1099 forms automatically. Its full-service payroll covers all 50 US states and includes tip reporting, direct deposits, and flexible payroll capabilities, such as multistate payroll processing and multiple pay options, rates, and schedules.

The platform also allows you to enter cash tips that staff receive during work hours to ensure tax on tips is calculated appropriately. This can be a huge time-saver and avoids manually doing these calculations.

Why I like it

In my evaluation, Gusto earned an overall score of 4.64 out of 5. It received perfect marks in nearly all criteria, including pricing, given its transparent fees, multiple plan options, unlimited pay runs, and a reasonably priced starter plan.

However, Gusto’s pricing isn’t as affordable as Square Payroll, SurePayroll, and Homebase Payroll. It also has limited health insurance coverage, and while its interface is intuitive, it isn’t fully customizable.

Users on third-party review sites like Gusto because it’s easy to integrate payroll into the workflow for any size business. They also raved about the autosync and tax payment features as going above and beyond other products.

When to use an alternative

Gusto may have next-day direct deposits, but this is available only in its higher tiers. For fast processing timelines that don’t require plan upgrades, I recommend QuickBooks Payroll, as its starter Simple plan comes with next-day direct deposits (same-day for premium plans). Square Payroll also offers instant payouts through its Square Payments solution.

If offering benefits is important to you and your business is located in one of the states where Gusto’s health insurance isn’t available, consider any of the providers in this guide, except Homebase Payroll, which doesn’t have benefits plans.

Add-ons

*This is available for the Simple plan holders; it’s free for Plus and Premium tiers.

Pricing: 5/5

Restaurant-specific features: 2.5/5

Payroll features: 4.38/5

HR features: 4.06/5

Popularity: 2.5/5

Reporting: 5/5

Expert review: 4/5

Ease of use: 3.63/5

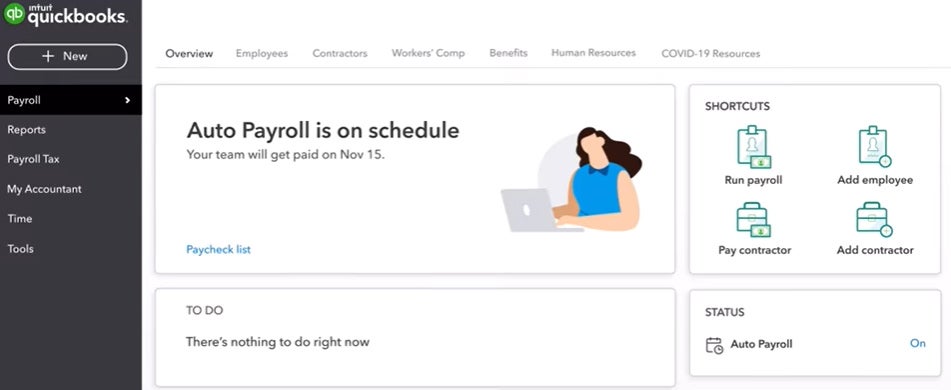

Who should use it

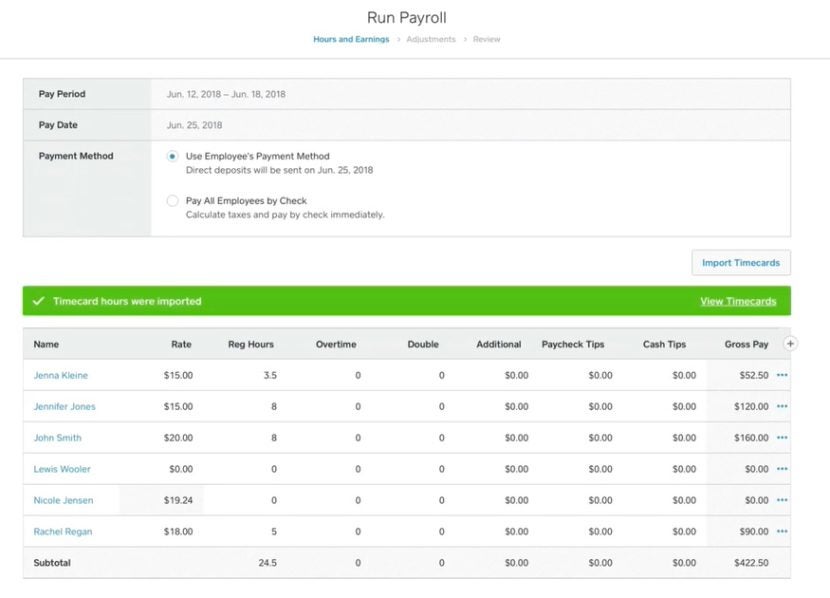

QuickBooks has released a Contractor Payments package that is optimal for businesses with only contract workers. For $15 per month, you can process payments for up to 20 workers (plus $2 for each additional contractor), e-file 1099 forms, and pay contractors via next-day direct deposits.

Why I like it

Based on my criteria, QuickBooks Payroll received an overall score of 3.96 out of 5. Fast, unlimited pay runs, automated payroll tax calculations, year-end filings, and customizable reports earned QuickBooks Payroll high marks for payment features and reporting tools.

It also has one of the fastest direct deposit timelines, processing within 24 hours. This time frame is unlike similar payroll software providers that typically offer two- or four-day processing.

In addition, it has restaurant-specific functionalities that allow you to track time and manage tips. The platform allows you to enter cash and credit card tips into its system, enabling it to withhold the applicable taxes. For cash tips, it calculates taxes but doesn’t include the tip in the employees’ actual pay when they receive the money as cash.

User ratings are average on third-party review sites; however, users like that it’s easy to set up and offers good customer service. One user even said they like how QuickBooks Payroll allows their small business to have the look and feel of a big corporation.

When to use an alternative

Unlike the other payroll software for restaurants I reviewed, you have to upgrade to either a higher plan if you want QuickBooks Payroll to handle your local tax filings. Plus, if you already have an accounting system and don’t plan to switch to QuickBooks, you’ll find more reasonably priced options for paying employees with SurePayroll, Square Payroll, and Homebase.

Payroll Core: $50 per month + $6.50 per employee monthly

Payroll Premium: $88 per month + $10 per employee monthly

Payroll Elite: $134 per month + $12 per employee monthly

Contractor payments package: Starts at $15 per month for 20 contractors, plus $2 for each additional contractor

Includes next-day direct deposits, 1099 e-filings, and a contractor self-setup tool

Pricing: 5/5

Restaurant-specific features: 3.13/5

Payroll features: 4.25/5

HR features: 3.5/5

Popularity: 0/5

Reporting: 5/5

Expert review: 4/5

Ease of use: 3.63/

Who should use it

Homebase Payroll is designed specifically for hourly teams, as it comes with essential scheduling and time tracking tools to help you manage your hourly workforce more efficiently. It offers job postings, applicant tracking, PTO management, new hire onboarding, and time clock apps.

The platform has added a payroll module to its suite of time tracking and scheduling solutions. Similar to Square Payroll, Homebase Payroll offers flat pricing for its easy-to-use pay processing solution, which includes automated payroll tax payment and filing services.

Why I like it

Homebase Payroll earned an overall score of 3.85 out of 5 in my evaluation. Its reasonably priced plan with flat pricing and robust HR tools contributed to its high scores (4 and up) in several criteria. However, the lack of online third-party Homebase Payroll reviews resulted in it getting a zero rating in my popularity criterion.

Homebase’s main platform ranks well among users on third-party review sites. Users like the scheduling and time tracking capabilities, as well as labor cost reporting. Others like the ability to cash out money early for the next check.

When to use an alternative

While Homebase Payroll is generally easy to use, it isn’t as simple to set up as most of the payroll software in this guide. It also only offers its two-day direct deposits to qualified companies.

If you don’t qualify, your direct deposit processing timeline will be four days. I recommend QuickBooks Payroll for fast payments that aren’t restricted to certain companies. If you prefer paper checks, ADP Run and Paychex can help you prepare them.

$39 per month + $6 per employee, per month:

Pricing: 3.25/5

Restaurant-specific features: 3.75/5

Payroll features: 4.13/5

HR features: 5/5

Popularity: 5/5

Reporting: 5/5

Expert review: 3.5/5

Ease of use: 3.25/5

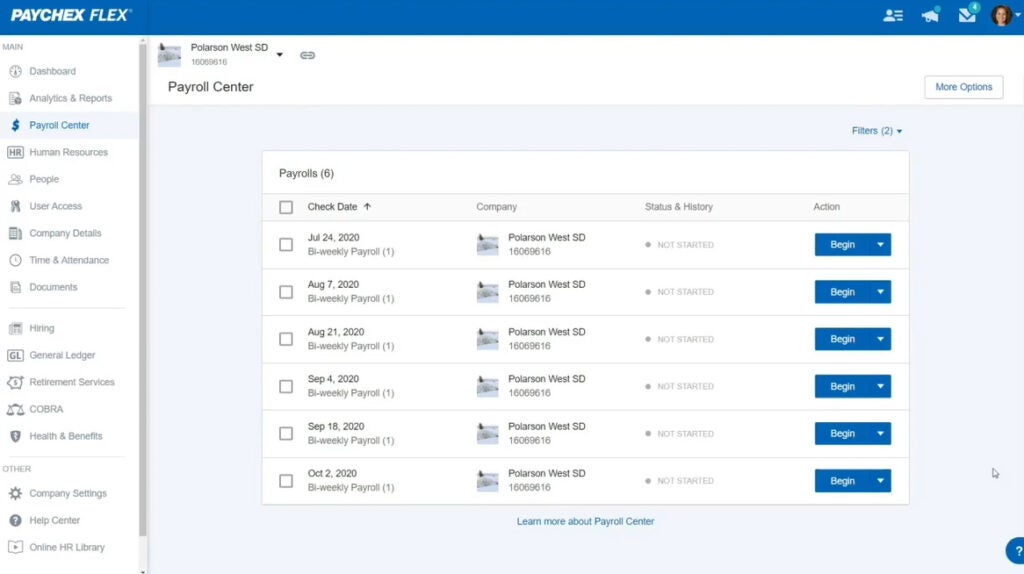

Who should use it

With Paychex Flex Select and Paychex Flex Pro, business owners get access to dedicated support representatives who can help with anything they need throughout the payroll process. This is a huge plus for business owners who want a DIY payroll approach but need expert support to feel confident.

You also get multiple pay options to process direct deposits, paper checks, and pay cards. Moreover, what sets it apart from other payroll providers is its pay-on-demand feature, providing your employees the option to access their earned pay (up to $500) before payday.

Why I like it

Paychex earned an overall rating of 3.84 out of 5 in my evaluation. It received high scores for payroll and HR features, primarily because it offers solutions for processing employee pay, managing payroll taxes, reporting tips, tracking attendance, onboarding new hires, and conducting background checks. Its platform even has employee performance and learning management tools.

Paychex averaged a 4.2 out of 5 across multiple third-party review sites. Users liked its analytics features and automated reporting capabilities. They also stated that its personalized customer service makes the product easy to use.

When to use an alternative

Paychex’s HR payroll platform may be too feature-rich for those only needing pay processing tools. If you don’t require learning management solutions and an employee handbook builder, try SurePayroll. Restaurants with small teams can benefit from the Full Service plan with tax filing support.

And, in case you only have up to 10 employees and prefer to file tax forms yourself (or have an in-house HR staff who can), SurePayroll has a low-cost “No Tax Filing” option.

Paychex Flex Select: $39 per month + $5 per employee

Paychex Flex Pro: Custom-priced

Paychex Flex Enterprise: Custom-priced

Paid add-ons:

Pricing: 5/5

Restaurant-specific features: 2.5/5

Payroll features: 3.63/5

HR features: 4.5/5

Popularity: 2.5/5

Reporting: 5/5

Expert review: 3.5/5

Ease of use: 3.63/5

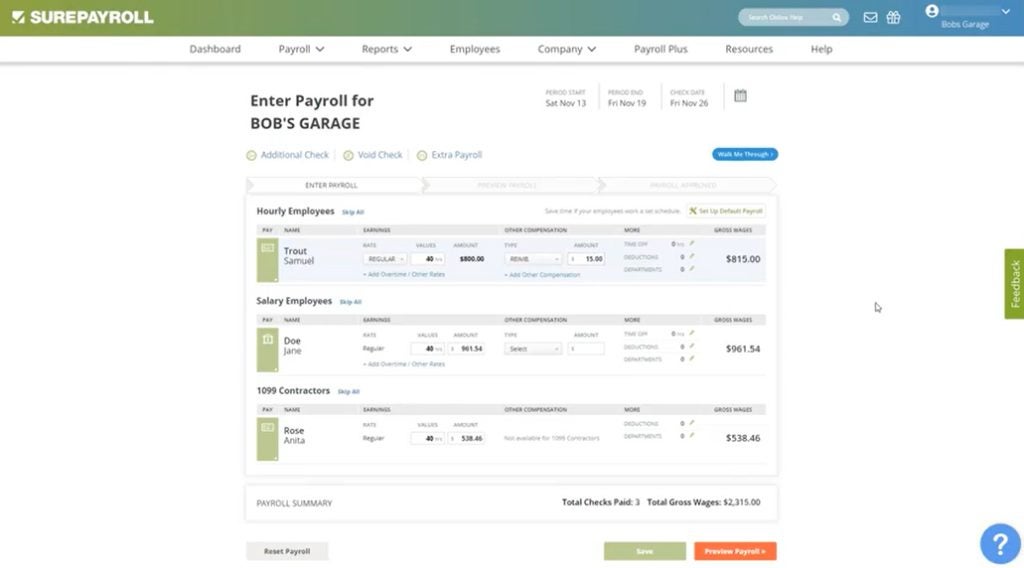

Who should use it

SurePayroll, a subsidiary of Paychex, is designed specifically for small businesses and is more affordable than other restaurant payroll solutions on my list. Its low-cost “No Tax Filing” plan allows you to run unlimited payrolls for a monthly fee of $20 plus $4 per employee.

This is a great option for small businesses that can handle their own tax filings. Its full-service plan, which includes unlimited pay runs and payroll tax filings, costs $29 plus $7 per employee monthly.

Why I like it

SurePayroll earned an overall score of 3.81 out of 5 in my evaluation. The software earned high scores (4 and up) for pricing, HR tools, and reporting capabilities. It would have ranked higher on my list if it had pay-on-demand and built-in time tracking functionalities. Its low popularity scores, primarily due to fewer than 1,000 user reviews in G2 and Capterra, also decreased its overall rating.

Aside from unlimited pay runs, SurePayroll can help you manage restaurant-specific taxes and payments. It has Federal Insurance Contribution Act (FICA) tip credit reports for tracking and calculating how much you claim on annual business taxes. It even offers tip sign-off reports, which can serve as written proof that your workers’ tips have been declared and received.

From a user standpoint, SurePayroll ranked well on third-party review sites. Users like the competitive pricing and how easy it is to set up and use. Plus, they report accurate federal and state tax filings and how easy payroll is to run and check for errors.

When to use an alternative

SurePayroll doesn’t integrate with POS systems. If you’re a Square POS user, consider Square Payroll. The closed system of Square means you will enter data manually, but it’s easier to work with alongside Square than POS-adjacent systems. Most other payroll software in this guide can connect with POS solutions if you’re a non-Square user.

Square Payroll, Gusto, ADP Run, OnPay, and Paychex are good options if you’re looking for multiple payment options, from direct deposits to manual checks. I recommend ADP Run for stress-free paycheck processing, as it offers check signing, stuffing, and delivery services.

When to use an alternative

Paychex’s HR payroll platform may be too feature-rich for those only needing pay processing tools. If you don’t require learning management solutions and an employee handbook builder, try SurePayroll. Restaurants with small teams can benefit from the Full Service plan with tax filing support.

And, in case you only have up to 10 employees and prefer to file tax forms yourself (or have an in-house HR staff who can), SurePayroll has a low-cost “No Tax Filing” option.

No Tax Filing: $20 + $4 per employee monthly

Full-Service: $29 + $7 per employee monthly

Additional plans & solutions:

Add-ons:

Pricing: 4/5

Restaurant-specific features: 2.5/5

Payroll features: 4/5

HR features: 4.75/5

Popularity: 2.5/5

Reporting: 5/5

Expert review: 4/5

Ease of use: 3.88/5

Who should use it

For those with in-house HR staff familiar with running payroll, OnPay allows you to delegate pay processing tasks and control payroll access through its six-level system permissions. None of the restaurant payroll services in this guide has system permissions that are as robust as OnPay’s. New clients even get set up and data migration support, including customization assistance for third-party software integrations.

What’s also great about this software is its restaurant-specific services that include automatic tip calculations and Form 8846 filings. If you’re a new restaurateur, it can even help you set up minimum wage tip calculations.

However, don’t expect to integrate your POS with this software. Its partner systems only include QuickBooks, Xero, QuickBooks Time, Deputy, and When I Work.

Why I like it

In my evaluation, OnPay earned an overall rating of 3.81 out of 5, with high scores (4 and up) in most of my criteria. It didn’t rank higher on my list because of its limited number of user reviews in G2 and Capterra (fewer than 1,000) and the lack of POS integrations.

Similar to Homebase Payroll and Square Payroll, OnPay offers flat pricing for its payroll and basic HR solutions, another reasonably priced payroll plan in this guide. It provides health benefits with coverage that extends to all US states.

Although the number of reviews was low, OnPay received the highest marks for third-party reviews of any other provider on my list. Users love how feature-laden and easy-to-use the platform is, both on desktop and mobile devices. They also liked the live chat feature when they have questions, with instant responses.

When to use an alternative

If you want to provide employees early access to earned wages, OnPay lacks the pay-on-demand feature that Square Payroll, Paychex, and ADP Run offer. Similar to Homebase Payroll, two-day direct deposits are only for qualified businesses. I recommend QuickBooks Payroll if you want fast direct deposits. Its standard processing timeline is a next-day option.

$49 + $6 per employee monthly

Pricing: 2/5

Restaurant-specific features: 4.38/5

Payroll features: 4.5/5

HR features: 5/5

Popularity: 3.75/5

Reporting: 5/5

Expert review: 4/5

Ease of use: 3.25/5

Who should use it

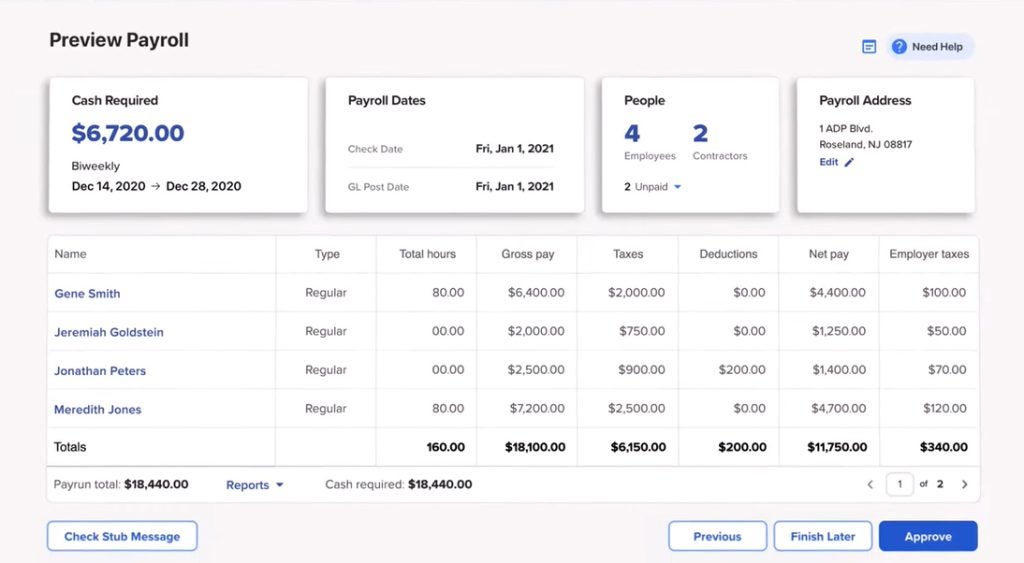

ADP Run is ADP’s web-based payroll solution that’s ideal for growing businesses. With many different plans available, ADP can tailor its platform and offerings to best fit the current needs of your business as it grows and evolves. It has all the essential features to process employee wages, manage payroll taxes, onboard new staff, and complete federal and state new hire reporting.

The software also has a time and attendance management module for restaurateurs that includes basic tip reporting tools. You can use ADP Run to process credit card tips, enter cash tip amounts, and withhold the applicable taxes. It can also provide FICA tip reports.

Why I like it

In my evaluation, ADP Run scored 3.76 out of 5. Its feature-rich platform and analytics earned this software high ratings (4 and up) for HR, payroll, and reporting tools. While few restaurant-specific features are available, unlike Gusto and Square, ADP Run offers strong reporting features and timekeeping, which are equally important for all restaurants to function properly.

Third-party reviews praise ADP Run for its straightforward interface and easy payroll handling. They also say their customer service is always polite and helpful. Plus, since it assumes 100% liability for wrongdoing, users feel at ease that their payroll is compliant and accurate.

When to use an alternative

Before you decide to get ADP Run, note that, based on a quote I received, it’s the most expensive payroll solution on my list. If you have a limited budget, consider either OnPay, SurePayroll, Square Payroll, or Homebase Payroll, as they all offer reasonably priced plans and unlimited pay runs.

While ADP handles year-end reporting — W-2s and 1099s — it charges extra. If you want full-service payroll without paying add-on tax filing fees, I recommend the other restaurant payroll software in this guide, except for Paychex, which also charges extra for year-end filings.

Essential: Custom-priced

Enhanced: $81.66 weekly to pay 25 employees, plus $1.89 per additional worker based on a quote acquired from ADP Run

Complete: Custom-priced

HR Pro: Custom-priced

I compared 14 reputable payroll providers that, apart from processing employee payroll, offer attendance management and restaurant-specific solutions, such as time tracking and tip reporting. I rated each on a five-star scale designed to assess restaurant payroll services, narrowing my list to the top eight.

Not all payroll software will be right for your restaurant business. When thinking about payroll options, consider your budget against the software’s scalability, support availability, and more.

The restaurant payroll services I reviewed offer tip payment processing, tax filing services, year-end tax reports, and full-service payroll for employees and contractors.

Most restaurants use a payroll system that integrates with point-of-sale (POS) payment processing systems. A POS can help with order processing, payments, and inventory control. Because of this, a POS that offers a payroll option, like Square, is ideal for restaurants.

According to recent statistics, payroll and labor costs for restaurants should not exceed 25%-30% of their total revenue. For every $10 generated, no more than $3 should be spent on payroll, benefits, and required taxes. For this reason, depending on the size of your restaurant, it is important to keep payroll costs low.

The best payroll software for small businesses depends on your business’s size, the payroll features you are looking for, and your budget. Gusto, for example, is the best restaurant payroll software for essential features. Meanwhile, Square Payroll is ideal for bars and cafes already using Square POS.

When looking for software that processes employee salaries and taxes, it’s important to consider whether it has industry-specific payroll features that fit your business’s requirements. For restaurants, you need a solution that offers payroll and tax processing, time tracking, HR support, and tip reporting functionalities to help restaurateurs maintain compliance. Platforms should also be affordable if you’re running small restaurants.

For these reasons, I chose Gusto as a top restaurant payroll software. It provides the greatest balance among features and offers a variety of tools that address restaurants’ needs. It also has an intuitive platform and a budget-friendly full-service payroll option.

Ray Delucci is a graduate of The Culinary Institute of America with a Bachelor’s in Food Business Management. He has experience managing restaurants in New York City, Houston, and Chicago. He is also the host of the Line Cook Thoughts Podcast, where he interviews and shares the stories of foodservice workers. Ray currently works in food manufacturing and food product development.

Property of TechnologyAdvice. © 2026 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this site are from companies from which TechnologyAdvice receives compensation. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. TechnologyAdvice does not include all companies or all types of products available in the marketplace.